Cash Out Refinance

This Isn T Your Father S Cash Out Refi

Can I Qualify For A Cash Out Mortgage

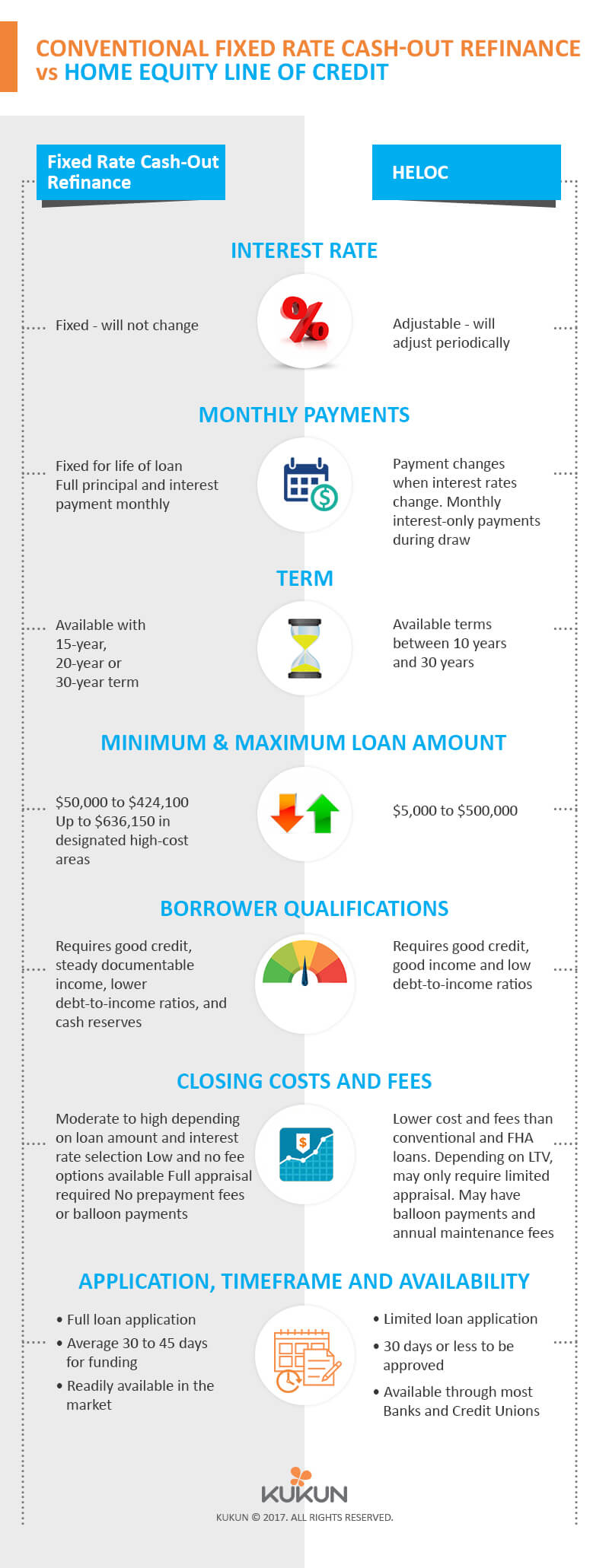

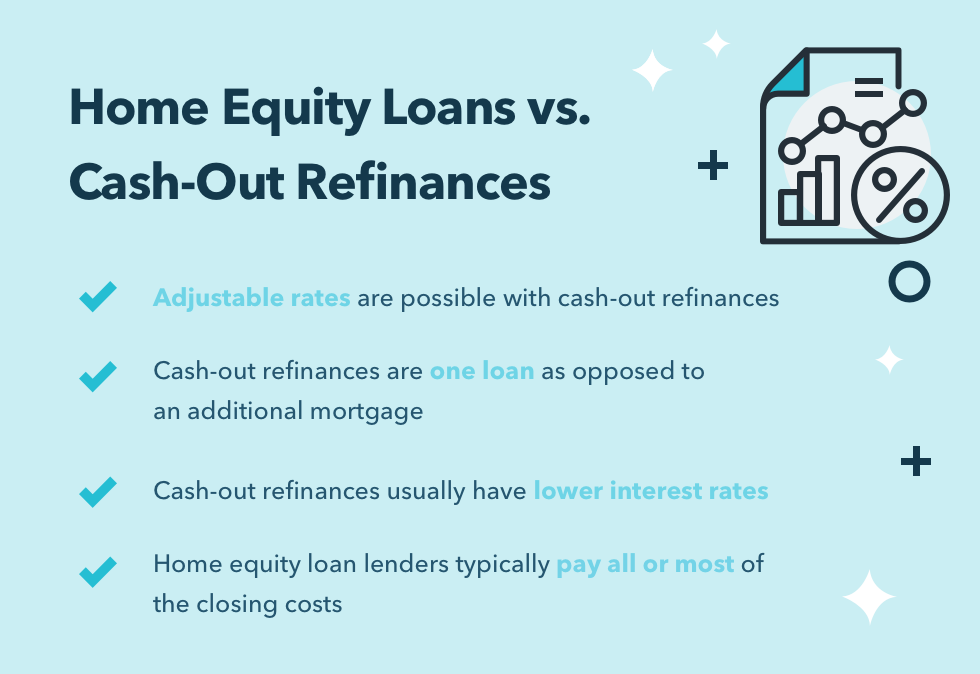

What Is The Difference Between Cash Out Refinance Vs Heloc

Cash Out Refinance Mortgage Mortgage Refinance Hd Png Download Transparent Png Image Pngitem

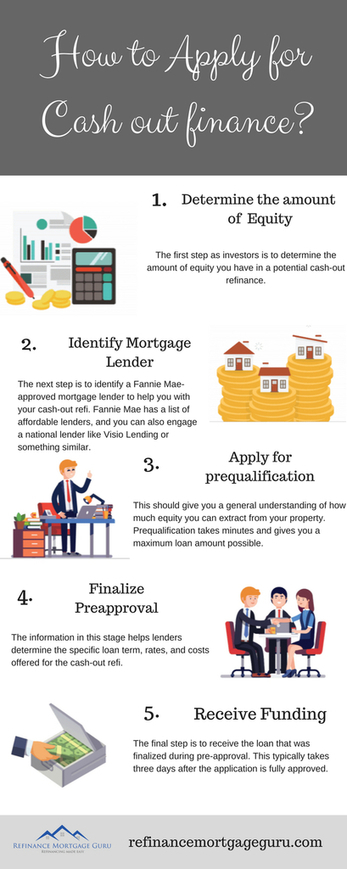

How To Select The Cash Out Refinance Investor By Flexible Funding Issuu

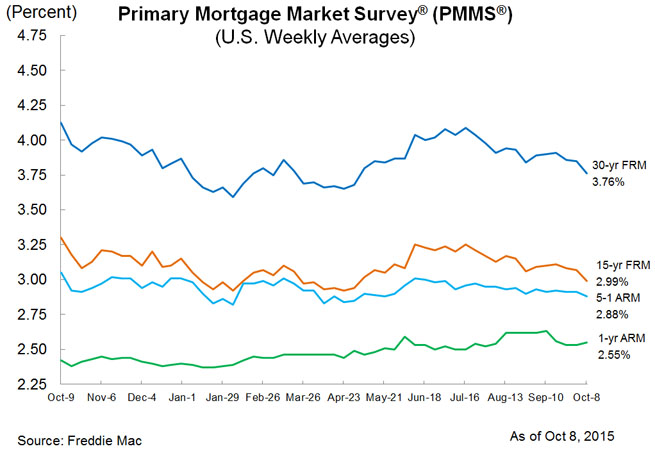

Cash Out Refinance Rush Is On As Mortgage Rates Fall Further Below 4 Nerdwallet

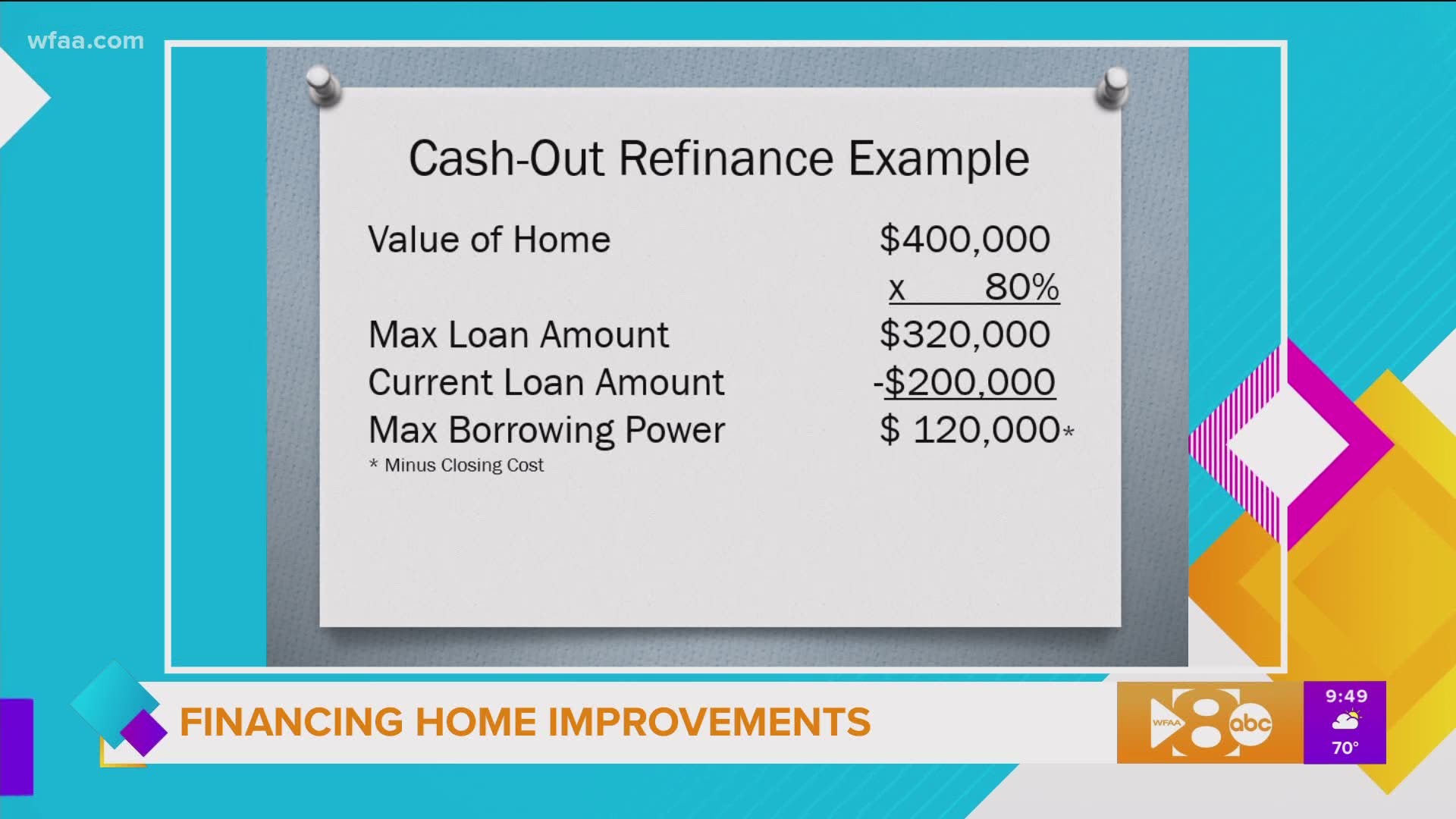

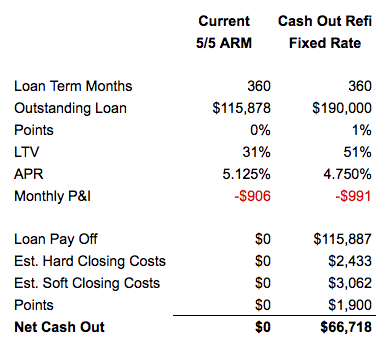

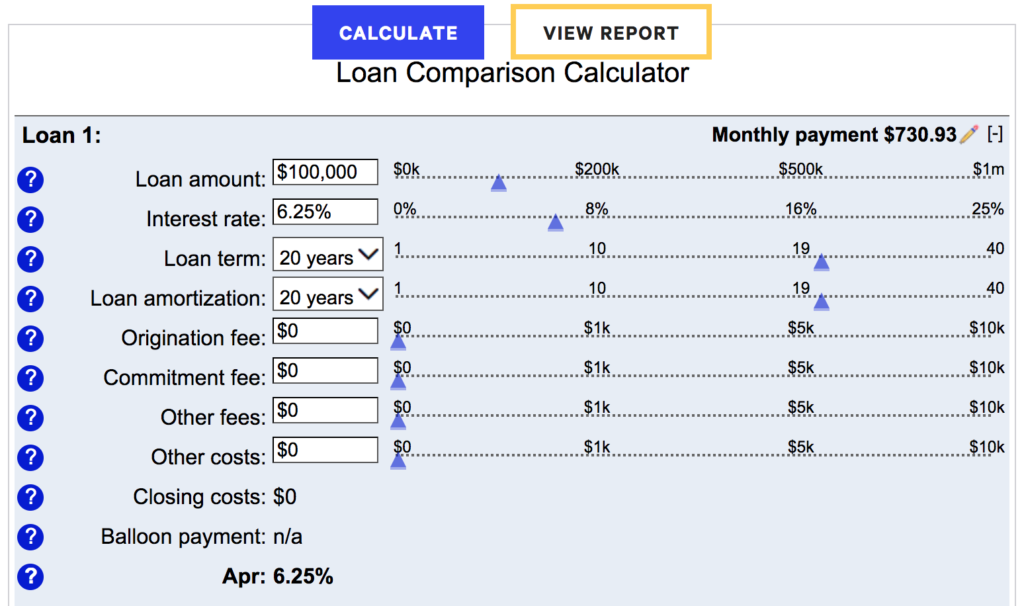

If you do a cash out refinance for $250,000 on a new 30year mortgage and are able to drop that interest rate from 45% down to 3%, your payment will go down to about $1,054 a month (again, before.

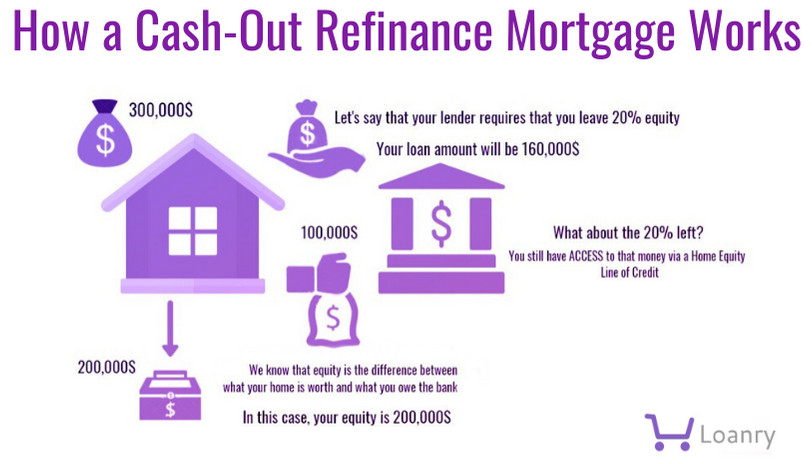

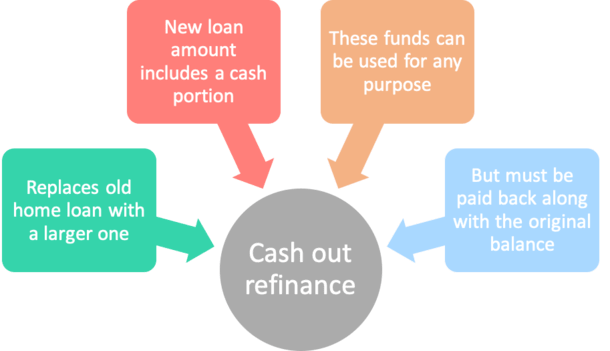

Cash out refinance. Cashout refinancing makes sense When you have the opportunity to use the equity in your home to consolidate other debt and reduce your total payments To pay for the cost of improvements that may increase the value of your home When you are unable to get other financing for a large purchase or. How Does A CashOut Refinance Work?. A cashout refinance lets you access your home equity by replacing your existing mortgage with a new one that has a higher loan amount than what you currently owe When you close on your loan, you’ll get funds you can use for other purposes Is a cashout refinance the right move for you?.

A cashout refinance lets you access your home equity by replacing your existing mortgage with a new one that has a higher loan amount than what you currently owe When you close on your loan, you’ll get funds you can use for other purposes Is a cashout refinance the right move for you?. Here are some common reasons to use a cashout refinance Get a lower interest rate on your mortgage – This is the most common reason why most people do a traditional refinance, Make valueadded home improvements or repairs to your home – Homeowners who use cashout refis for these types of. If you do a cash out refinance for $250,000 on a new 30year mortgage and are able to drop that interest rate from 45% down to 3%, your payment will go down to about $1,054 a month (again, before.

CashOut Refinance Pros and Cons Pros of a cashout refinance Lower interest rates A mortgage refinance typically offers a lower interest rate than a Cons of a cashout refi Foreclosure risk Because your home is the collateral for any kind of mortgage, you risk losing The bottom line A. How Does A CashOut Refinance Work?. CashOut Refinance Pros and Cons Pros of a cashout refinance Lower interest rates A mortgage refinance typically offers a lower interest rate than a Cons of a cashout refi Foreclosure risk Because your home is the collateral for any kind of mortgage, you risk losing The bottom line A.

Here are some common reasons to use a cashout refinance Get a lower interest rate on your mortgage – This is the most common reason why most people do a traditional refinance, Make valueadded home improvements or repairs to your home – Homeowners who use cashout refis for these types of. How Does A CashOut Refinance Work?. CashOut Refinance Pros and Cons Pros of a cashout refinance Lower interest rates A mortgage refinance typically offers a lower interest rate than a Cons of a cashout refi Foreclosure risk Because your home is the collateral for any kind of mortgage, you risk losing The bottom line A.

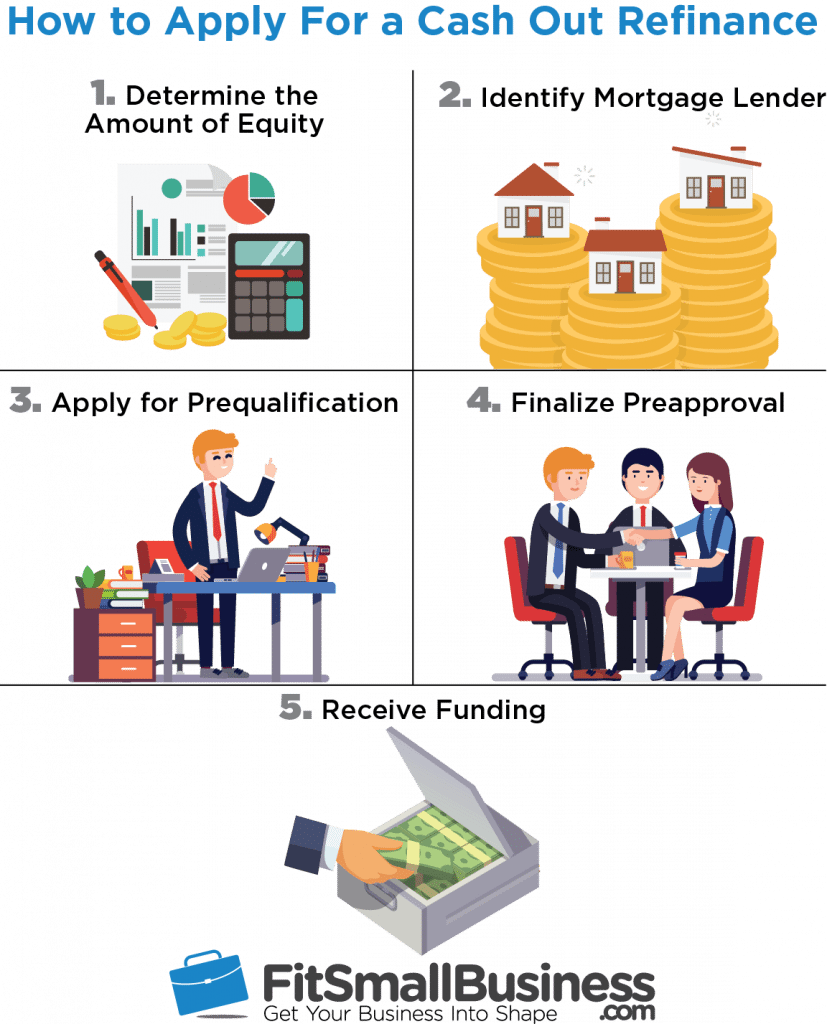

Requirements Your lender sets their own requirements when it comes to deciding who qualifies for a refinance A Adding It All Up Once you know that you meet the requirements for a cashout refinance, determine how much money you Getting Approved. A cashout refinance lets you access your home equity and refinance your mortgage at the same time When you use a cashout refinance, your new loan will be larger than what you currently owe on. CashOut Refinance Pros and Cons Pros of a cashout refinance Lower interest rates A mortgage refinance typically offers a lower interest rate than a Cons of a cashout refi Foreclosure risk Because your home is the collateral for any kind of mortgage, you risk losing The bottom line A.

Here are some common reasons to use a cashout refinance Get a lower interest rate on your mortgage – This is the most common reason why most people do a traditional refinance, Make valueadded home improvements or repairs to your home – Homeowners who use cashout refis for these types of. A cashout refinance lets you access your home equity by replacing your existing mortgage with a new one that has a higher loan amount than what you currently owe When you close on your loan, you’ll get funds you can use for other purposes Is a cashout refinance the right move for you?. A cashout refinance can be a good way to pay for home improvements Other uses may put your home at risk.

A cashout refinance can be a good way to pay for home improvements Other uses may put your home at risk. A cashout refinance lets you access your home equity and refinance your mortgage at the same time When you use a cashout refinance, your new loan will be larger than what you currently owe on. Key Takeaways In a cashout refinance, a new mortgage is for more than your previous mortgage balance, and the difference is paid to You usually pay a higher interest rate or more points on a cashout refinance mortgage, compared to a rateandterm A lender will determine how much cash you can.

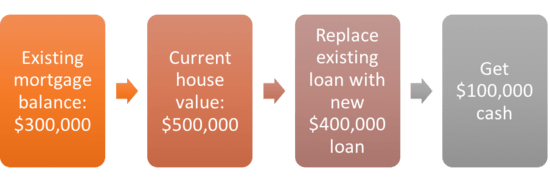

A cashout refinance is a refinancing of an existing mortgage loan, where the new mortgage loan is for a larger amount than the existing mortgage loan, and you (the borrower) get the difference between the two loans in cash Basically, homeowners do cashout refinances so they can turn some of the equity they’ve built up in their home into cash. A cashout refinance lets you access your home equity by replacing your existing mortgage with a new one that has a higher loan amount than what you currently owe When you close on your loan, you’ll get funds you can use for other purposes Is a cashout refinance the right move for you?. Here are some common reasons to use a cashout refinance Get a lower interest rate on your mortgage – This is the most common reason why most people do a traditional refinance, Make valueadded home improvements or repairs to your home – Homeowners who use cashout refis for these types of.

A cashout refinance can be a good way to pay for home improvements Other uses may put your home at risk. Requirements Your lender sets their own requirements when it comes to deciding who qualifies for a refinance A Adding It All Up Once you know that you meet the requirements for a cashout refinance, determine how much money you Getting Approved. A cashout refinance can be a good way to pay for home improvements Other uses may put your home at risk.

Key Takeaways In a cashout refinance, a new mortgage is for more than your previous mortgage balance, and the difference is paid to You usually pay a higher interest rate or more points on a cashout refinance mortgage, compared to a rateandterm A lender will determine how much cash you can. Here are some common reasons to use a cashout refinance Get a lower interest rate on your mortgage – This is the most common reason why most people do a traditional refinance, Make valueadded home improvements or repairs to your home – Homeowners who use cashout refis for these types of. A cashout refinance is a refinancing of an existing mortgage loan, where the new mortgage loan is for a larger amount than the existing mortgage loan, and you (the borrower) get the difference between the two loans in cash Basically, homeowners do cashout refinances so they can turn some of the equity they’ve built up in their home into cash.

Requirements Your lender sets their own requirements when it comes to deciding who qualifies for a refinance A Adding It All Up Once you know that you meet the requirements for a cashout refinance, determine how much money you Getting Approved. If you do a cash out refinance for $250,000 on a new 30year mortgage and are able to drop that interest rate from 45% down to 3%, your payment will go down to about $1,054 a month (again, before. Cashout refinancing makes sense When you have the opportunity to use the equity in your home to consolidate other debt and reduce your total payments To pay for the cost of improvements that may increase the value of your home When you are unable to get other financing for a large purchase or.

Key Takeaways In a cashout refinance, a new mortgage is for more than your previous mortgage balance, and the difference is paid to You usually pay a higher interest rate or more points on a cashout refinance mortgage, compared to a rateandterm A lender will determine how much cash you can. Cashout refinancing makes sense When you have the opportunity to use the equity in your home to consolidate other debt and reduce your total payments To pay for the cost of improvements that may increase the value of your home When you are unable to get other financing for a large purchase or. A cashout refinance lets you access your home equity and refinance your mortgage at the same time When you use a cashout refinance, your new loan will be larger than what you currently owe on.

A cashout refinance lets you access your home equity by replacing your existing mortgage with a new one that has a higher loan amount than what you currently owe When you close on your loan, you’ll get funds you can use for other purposes Is a cashout refinance the right move for you?. Cashout refinancing makes sense When you have the opportunity to use the equity in your home to consolidate other debt and reduce your total payments To pay for the cost of improvements that may increase the value of your home When you are unable to get other financing for a large purchase or. Requirements Your lender sets their own requirements when it comes to deciding who qualifies for a refinance A Adding It All Up Once you know that you meet the requirements for a cashout refinance, determine how much money you Getting Approved.

Cashout refinancing makes sense When you have the opportunity to use the equity in your home to consolidate other debt and reduce your total payments To pay for the cost of improvements that may increase the value of your home When you are unable to get other financing for a large purchase or. If you do a cash out refinance for $250,000 on a new 30year mortgage and are able to drop that interest rate from 45% down to 3%, your payment will go down to about $1,054 a month (again, before. How Does A CashOut Refinance Work?.

Key Takeaways In a cashout refinance, a new mortgage is for more than your previous mortgage balance, and the difference is paid to You usually pay a higher interest rate or more points on a cashout refinance mortgage, compared to a rateandterm A lender will determine how much cash you can. A cashout refinance is a refinancing of an existing mortgage loan, where the new mortgage loan is for a larger amount than the existing mortgage loan, and you (the borrower) get the difference between the two loans in cash Basically, homeowners do cashout refinances so they can turn some of the equity they’ve built up in their home into cash. A cashout refinance can be a good way to pay for home improvements Other uses may put your home at risk.

How Does A CashOut Refinance Work?. Key Takeaways In a cashout refinance, a new mortgage is for more than your previous mortgage balance, and the difference is paid to You usually pay a higher interest rate or more points on a cashout refinance mortgage, compared to a rateandterm A lender will determine how much cash you can. A cashout refinance is a refinancing of an existing mortgage loan, where the new mortgage loan is for a larger amount than the existing mortgage loan, and you (the borrower) get the difference between the two loans in cash Basically, homeowners do cashout refinances so they can turn some of the equity they’ve built up in their home into cash.

A cashout refinance is a refinancing of an existing mortgage loan, where the new mortgage loan is for a larger amount than the existing mortgage loan, and you (the borrower) get the difference between the two loans in cash Basically, homeowners do cashout refinances so they can turn some of the equity they’ve built up in their home into cash. CashOut Refinance Pros and Cons Pros of a cashout refinance Lower interest rates A mortgage refinance typically offers a lower interest rate than a Cons of a cashout refi Foreclosure risk Because your home is the collateral for any kind of mortgage, you risk losing The bottom line A. Requirements Your lender sets their own requirements when it comes to deciding who qualifies for a refinance A Adding It All Up Once you know that you meet the requirements for a cashout refinance, determine how much money you Getting Approved.

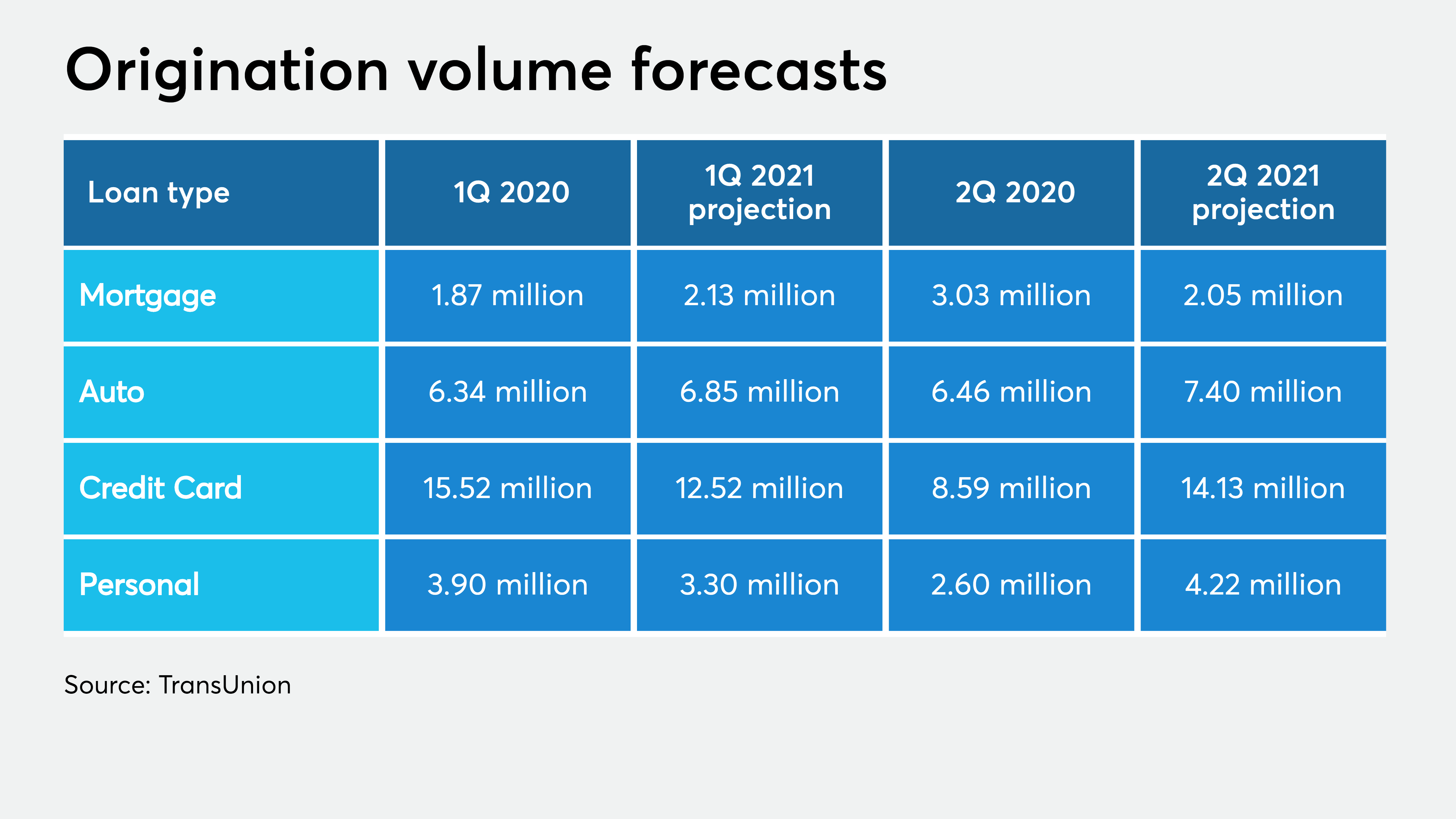

21 Forecast Predicts Cash Out Refinance Activity Spike National Mortgage News

Your Cash Out Refinance Playbook From Cnn The Basis Point The Basis Point

What Is The Difference Between Cash Out Refinance Vs Heloc

This Isn T Your Father S Cash Out Refi

Cash Out Refinance Mortgage Lender Home Loan Refinance Northwest Arkansas

What Is A Cash Out Refinance The Truth About Mortgage

Is Cash Out Refinance A Good Idea Even During A Pandemic Fox Business

The Cash Out Refinance Loan Delmar Mortgage

Moet Je Een Cash Out Refinance Op Je Huis Doen Voor Investeringen Banken

Heloc Vs Cash Out Refinance

Mitello Camay Cash Out Refinance Equity Learning

What Is A Cash Out Refinance And How It Can Help You The Fioneers

Cash Out Refinance How It Works And When To Get One

What Does Limited Cash Out Refinance Mean Xpress Lending

Cash Out Refinance For Paying Off Debt Youtube

Can I Qualify For A Cash Out Mortgage

Delayed Mortgage Waives 6 Month Waiting Period For Cash Out

Cash Out Refinance Vs Home Equity Line Of Credit Heloc Kings Mortgage Services Inc

Is A Cash Out Refinance Right For You Better Mortgage

Cash Out Refinance Mortgage Loan Eligibility Guidelines

Can I Get A Bank Statement Cash Out Refinance Loan

A5lcacamhqfz2m

The Ups And Downs Of Cash Out Refinance In Texas Texaslending Com

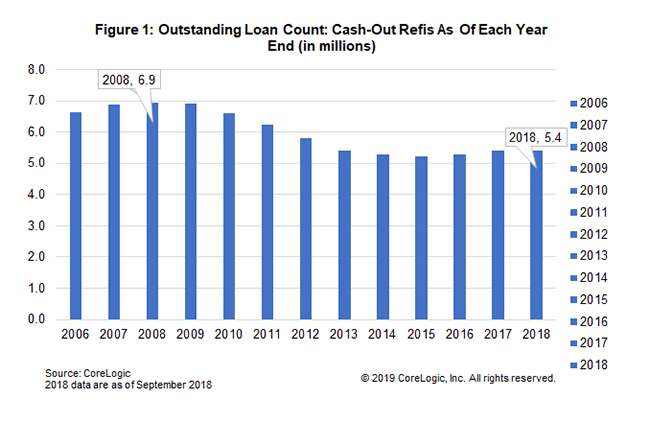

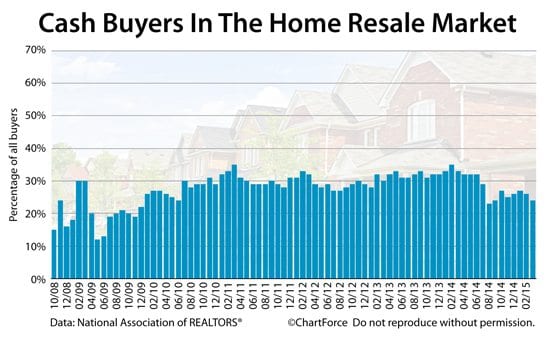

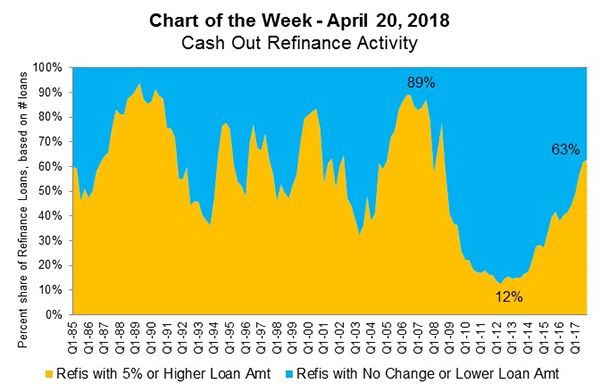

Mba Chart Of The Week Cash Out Refinance Activity Mba Newslink

8 Steps To A Successful Cash Out Refinance In Texas Texaslending Com

How Do Cash Out Refinances Work Mintlife Blog

Choosing Between Irrrl And Va Cash Out Refi Irrrl

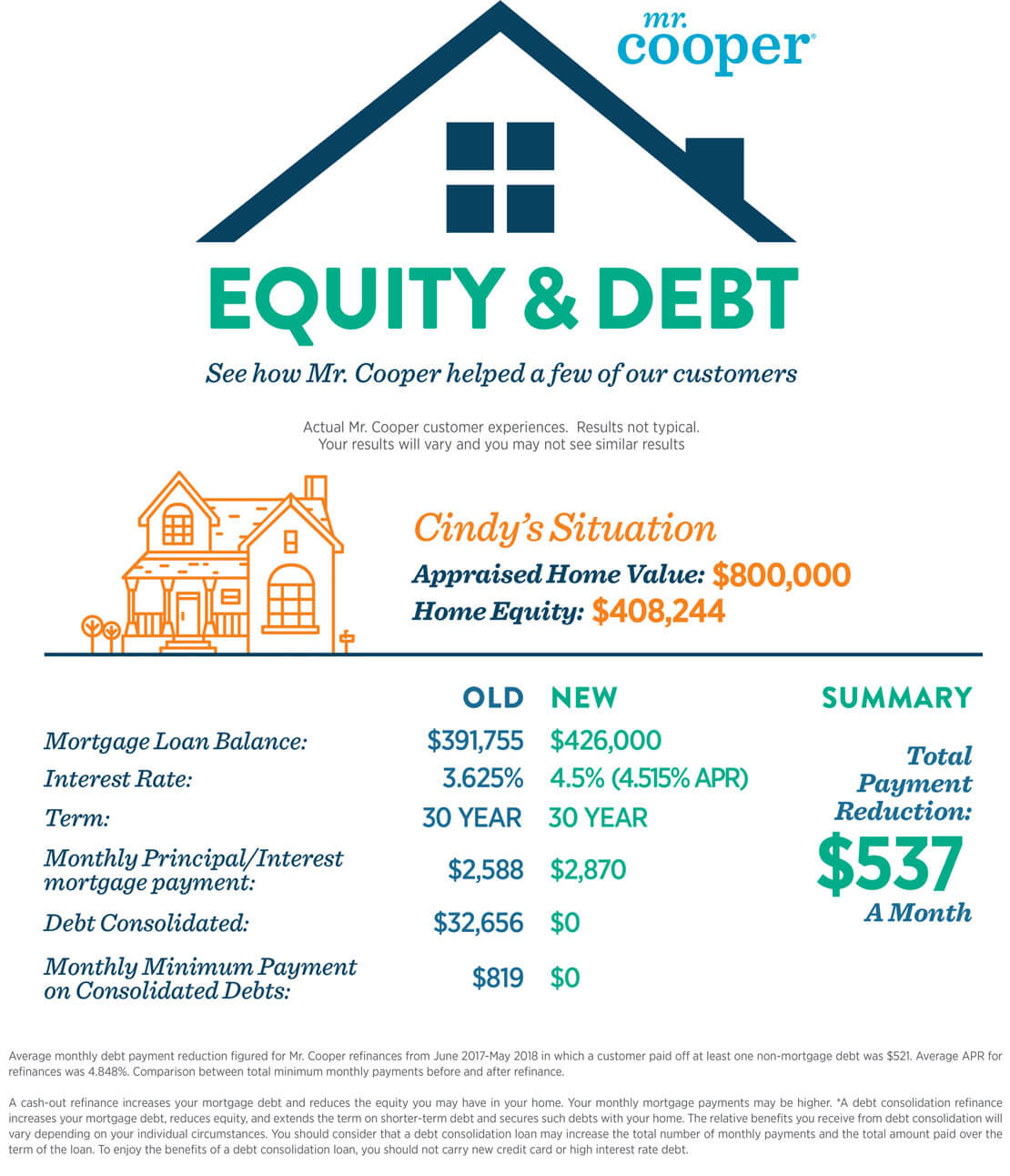

What Is A Cash Out Refinance The Mr Cooper Blog

Cash Out Refinance Mortgage Rates

Cash Out Refinance To Use Your Home Like A Bank Loanry

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

Cash Out Refinance Definition

How To Cash Out Refinance A Loan Bigger Than 417k Sonoma County Mortgages

Cash Out Refinancing In Nh Blue Water Mortgage

Rate And Term Refinance Concept Icon Stock Vector Illustration Of Insurance Blue

Cash Out Refinance Options For Home Improvements Wfaa Com

Cash Out Refinance Sample Letter Of Explanation For Cash Out Refinance

Arizona Cash Out Refinance

Cash Out Hoe Wordt Een Cash Out Berekend

Fha Cash Out Refinance Mortgages Mortgagee Letter 19 11 Black Mann Graham L L P

Cash Out Refinance For Investors Rates Terms Lenders

Cash Out Refi Massachusetts Mortgage Broker Custom Financial

Cash Out Refinance 101 All You Need To Know The Smart Investor

3 Reasons To Do A Cash Out Refinance Of An Investment Property Diligent Dollar

Is A Cash Out Refinance A Good Idea Summit Of Coin

Tn Mortgages Tn Mortgage Rates And Home Loans

Va Cash Out Refinance 100 Ltv Youtube

Cash Out Refinance Lenders Homefirst Mortgage Bankers

Www Benefits Va Gov Homeloans Documents Docs Cash Out Refinance User Guide Pdf

Pros And Cons Of A Cash Out Refinance Clever Girl Finance

Quarterly Refinance Report Freddie Mac

Cash Out Refinance Vector Photo Free Trial Bigstock

Cash Out Refinance Cash Out Refinance Cash Out Debt Counseling

Frsmqtdjq0jjnm

7 Step Cash Out Refi Rental Property Case Study Accidental Rental

Homeowners Using Cash Out Refi For Emergency Funds Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Does A Cash Out Refinance Work

Cash Out Max Cash Out Refinance Pros

Late Payments Hurt Your Chances For A Cash Out Refinance

1

Benefits And Advantages Of Cash Out Refinance

Refinance With Hard Money Sun Pacific Mortgage Real Estate Hard Money Loans In California

When To Use A Cash Out Refinance Forbes Advisor

Q Tbn And9gcti2zoxuuhniiq Aimo5e1p9 Prressxgs0wrdtvhw8kxrmqk Usqp Cau

How Should I Use My Fha Cash Out Refinance Money

5 Critical Facts You Should Know About Cash Out Refinance Healthy Lifestyle Tips And Travel

How A Cash Out Refinance Works Freeandclear Home Equity Loan Refinance Mortgage Home Equity

1

What Is A Cash Out Refinance The Truth About Mortgage

Home Equity Vs Heloc Vs Cash Out Refinance Keeping On

All You Need To Know About Cash Out Refinance

Cash Out Refinance Refinancing A Mortgage For Cash Karen Gustin Mortgage Services Expert

Cash Out Refinance Mortgage 17 Pros Cons What Is Cash Out Refinance Advisoryhq

A Guide To Cash Out Refinancing

Cash Out Refinance

Cash Out Refinance Nortex Mortgage

Should I Refinance My Home Peglar Real Estate Group Mountain Home Ar

Student Loan Cash Out Refinance Program Fairway Independent Mortgage Corporation

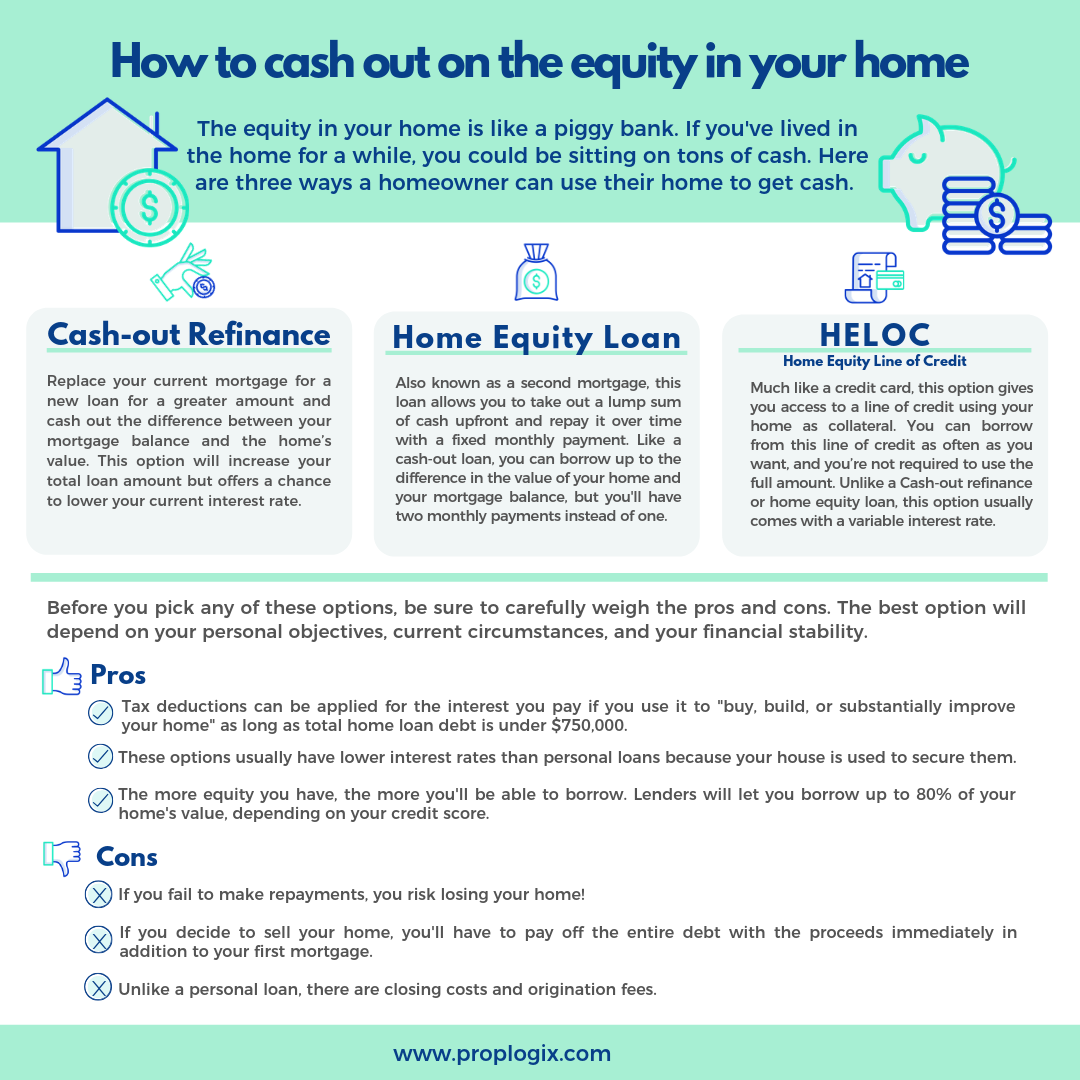

Refinancing How Homeowners Can Save Money Or Cash Out Their Equity Proplogix

Understanding The Benefits Of Approaching Cash Out Refinance Investor

Cash Out Refinancing Is On The Rise Again Here S Why We Aren T Worried Urban Institute

Cash Out Refinance Vector Photo Free Trial Bigstock

Is Money From A Cash Out Refinance Taxable Subprime Biz

Cash Out Refinancing How It Works Nextadvisor With Time

What Is A Cash Out Refinance How Does It Work Ally

Cash Out Refinance Vs Home Equity Line Of Credit Know All

The Ins And Outs Of A Cash Out Refinance F M Trust

Heloc Vs Refinance Or Something Else Real Finance Guy

Home Equity Loan Vs Cash Out Refinance Mintlife Blog

What Is Cash Out Refinance Afinoz

What Are The Tax Implications Of A Cash Out Refinance The Simple Dollar

Amazon Com The Beginner S Guide To Cash Out Refinancing For Real Estate Investors The Best Kept Secret In Real Estate Investing Revealed Ebook Hathcock Dana Kindle Store

7 Step Cash Out Refi Rental Property Case Study Accidental Rental

What Is A Cash Out Refinance Loans Canada

Cash Out Refinance How It Works And When To Get One

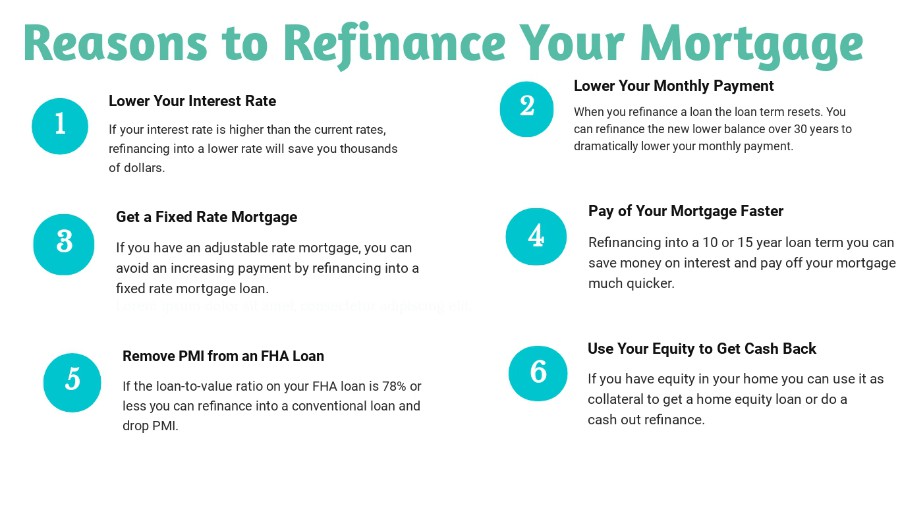

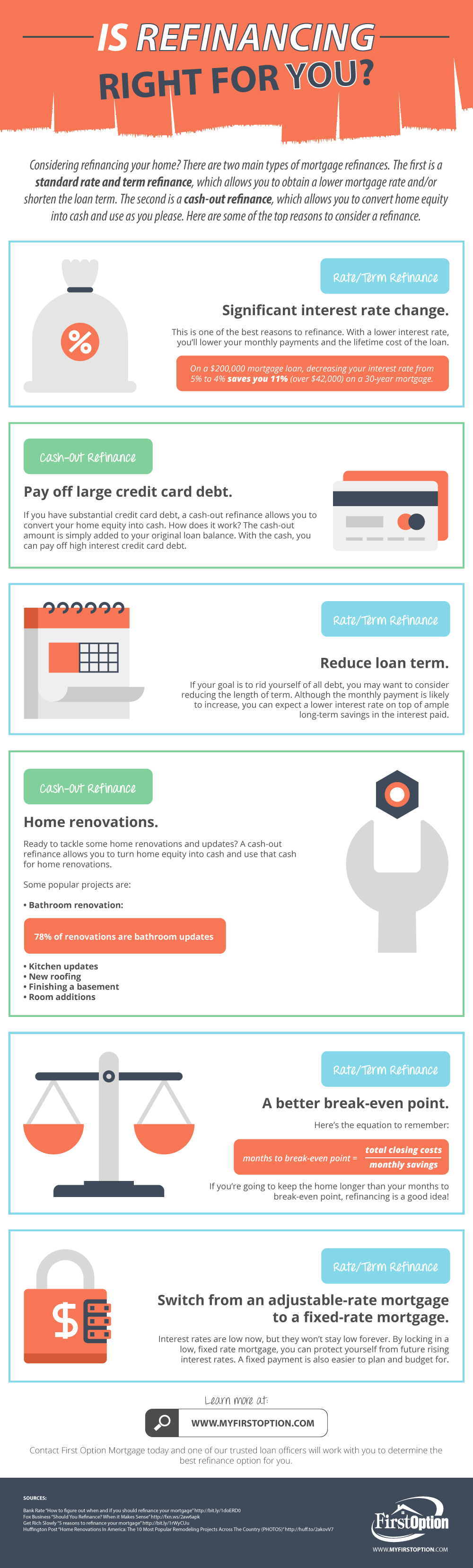

Is Refinancing Right For You Infographic

Va Cash Out Refinance Loan Military Benefits

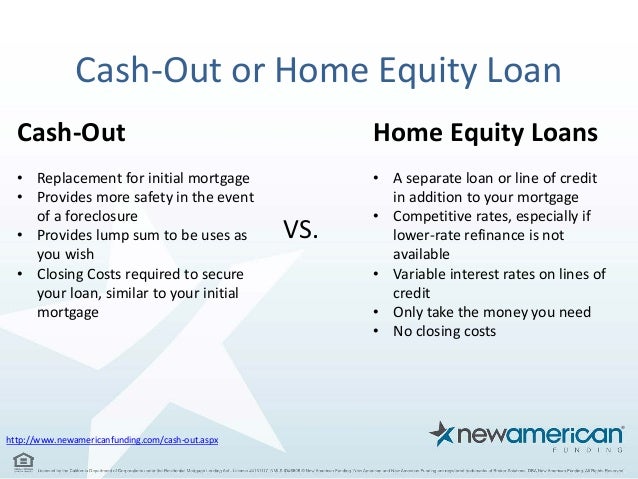

Cash Out Refinance Infographic New American Funding