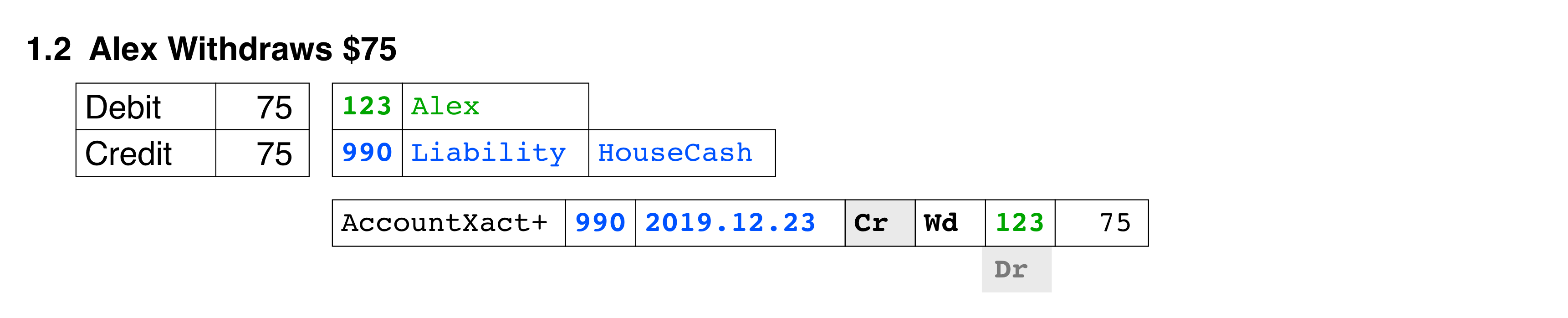

Cash Withdrawal Journal Entry

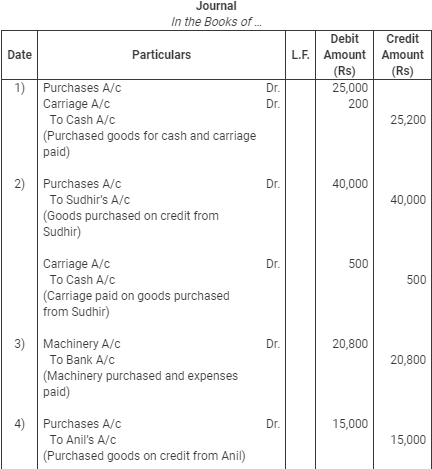

Drawings Journal Entry Goods Cash With Examples Accountingcapital

Pass The Journal Entry Of Sahil Brainly In

Closing Journal Entries Double Entry Bookkeeping

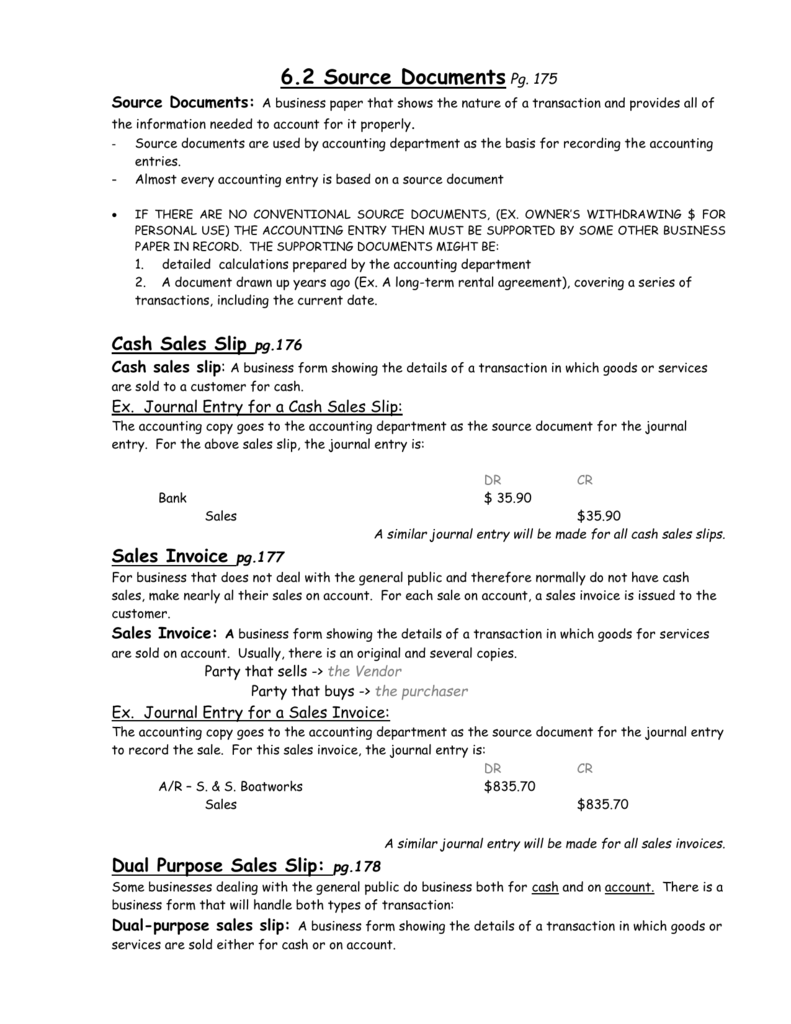

6 2 Source Documents Doc

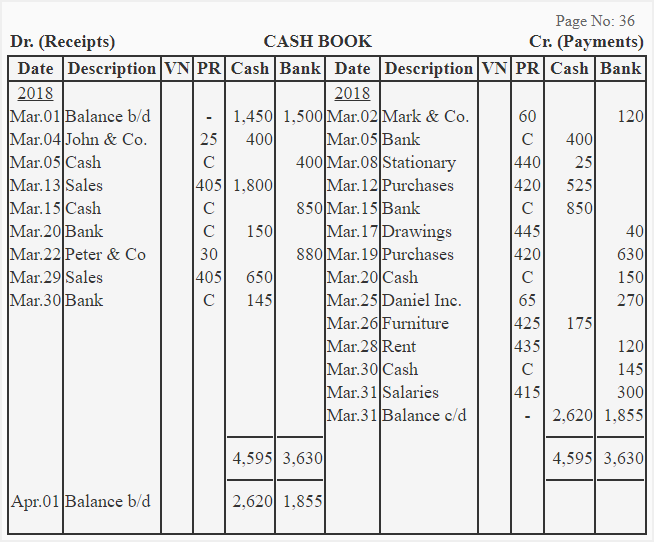

Double Column Cash Book Explanation Format Example Accounting For Management

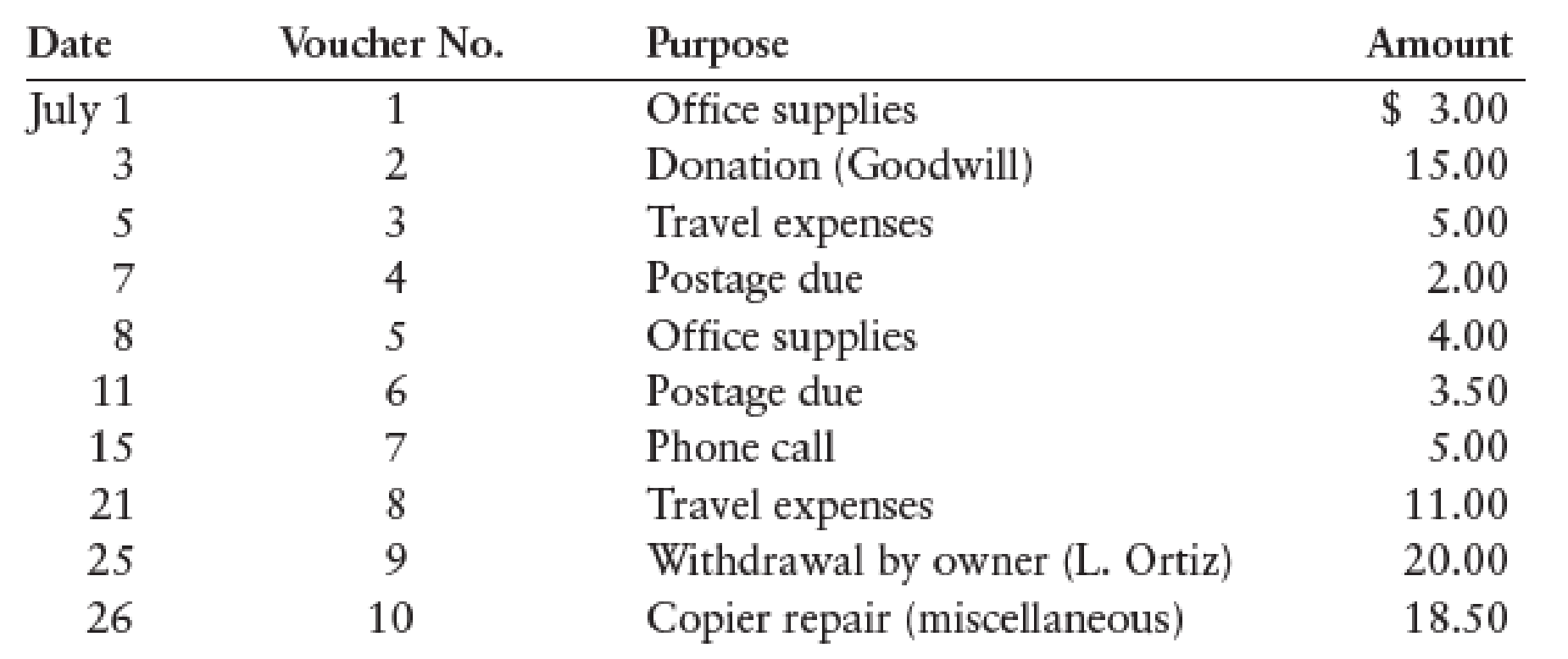

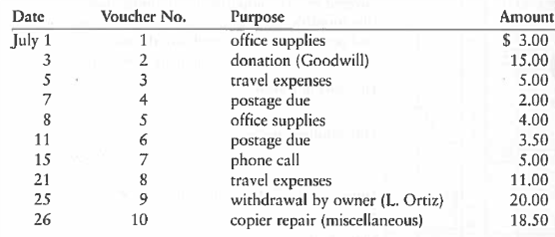

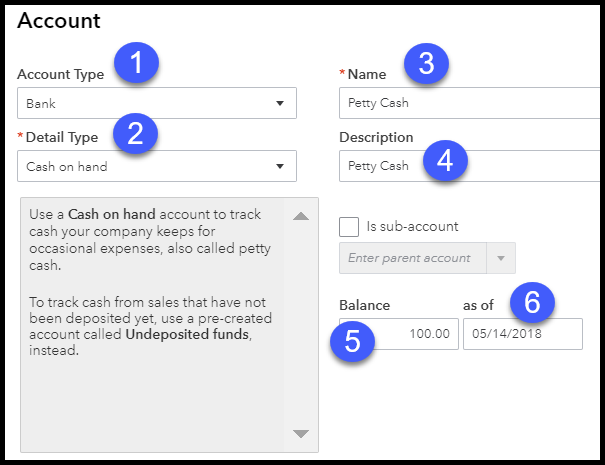

Petty Cash Record And Journal Entries On July 1 A Petty Cash Fund Was Established For 100 The Following Vouchers Were Issued During July Required 1 Prepare The Journal Entry To Establish

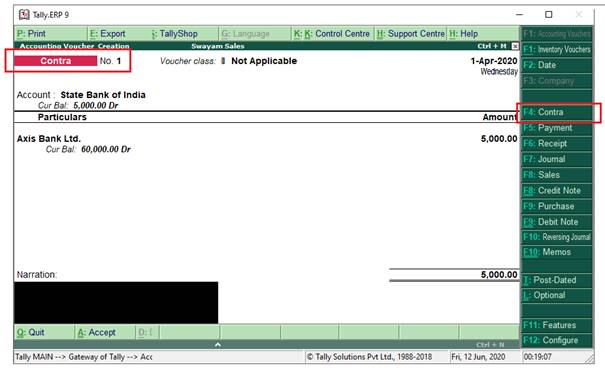

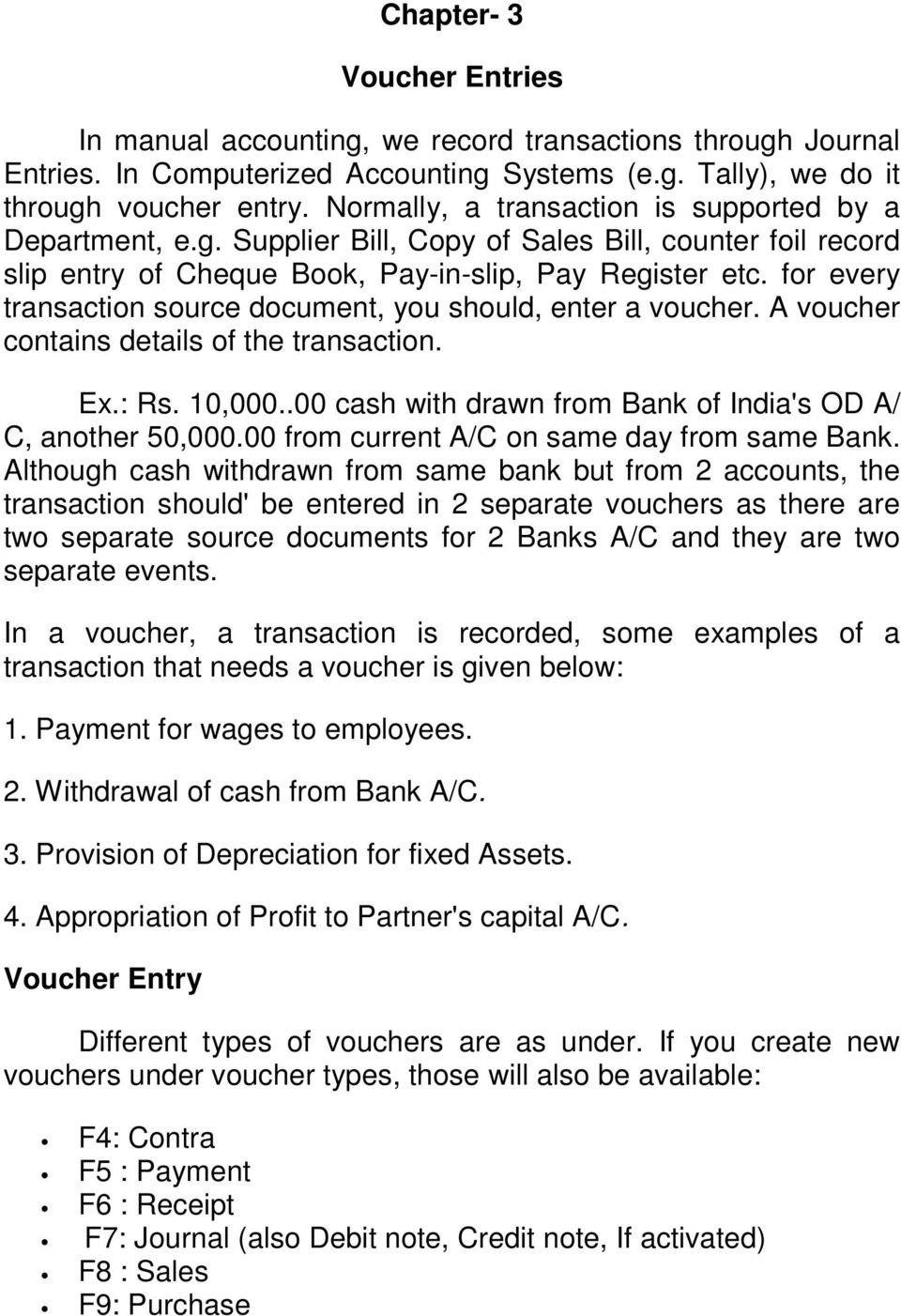

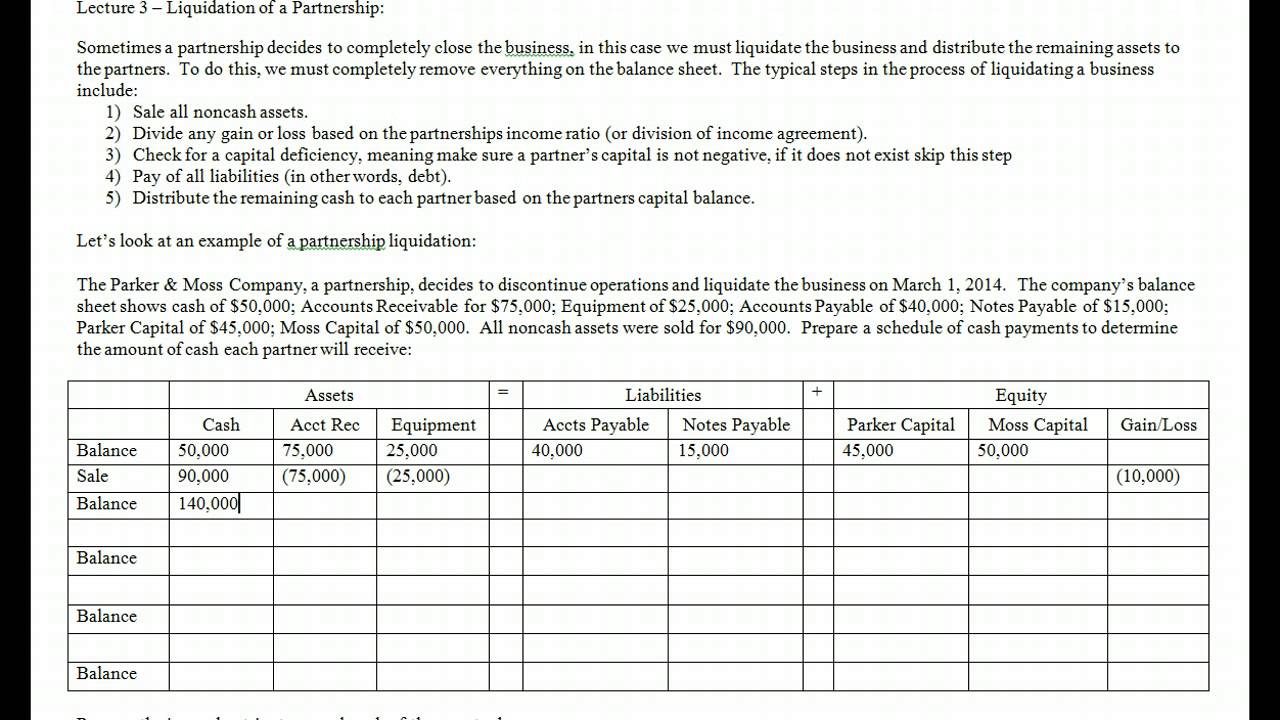

Before going to actual accounting entry, one should know the basic of accounting and debit and credit rules to under stand which account in tally should be debited and which should be credited On special request of one tally nine reader, I am posting here how to make cash deposit and withdrawal entry in tally.

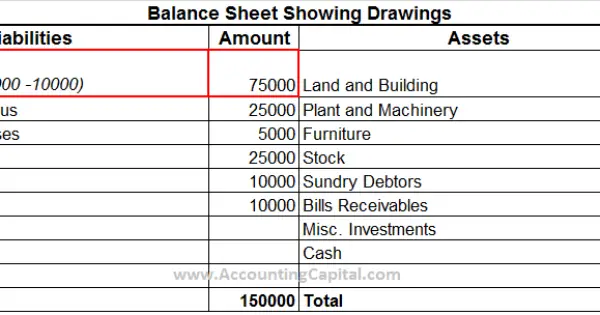

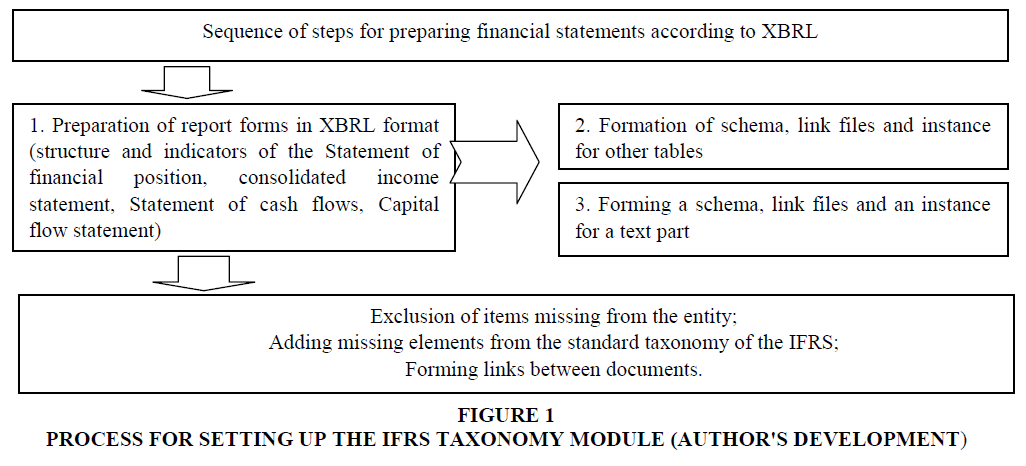

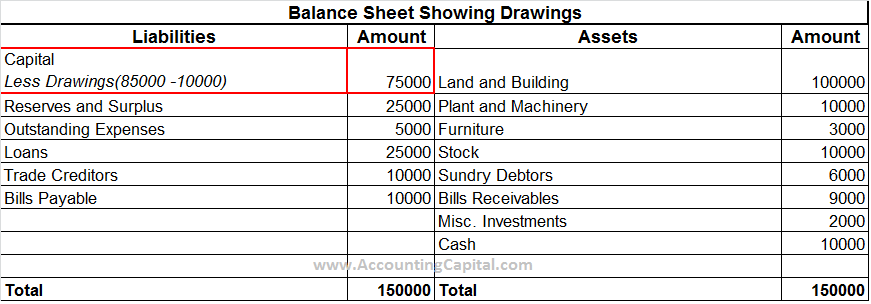

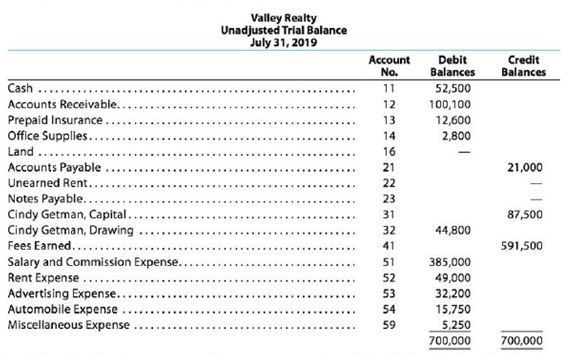

Cash withdrawal journal entry. At the end of the accounting period, when the accounts are closed the withdrawal account is posted in the capital account by passing a closing entry Thus, this portrays that the withdrawal of cash or assets by a partner or a sole proprietor decreases their stake in the company but does not affect its ownership. LF in the journal would mean ledger folio number 10,000 in Cash from Bank ?. To record contra entries, traditionally a cash book with cash and bank columns is prepared where both the aspects of the transaction will be entered in the same book which is Contra Book In the debit side of the contra book, ‘To Cash A/c’ will be entered under the particulars column and the amount will be entered in the bank column.

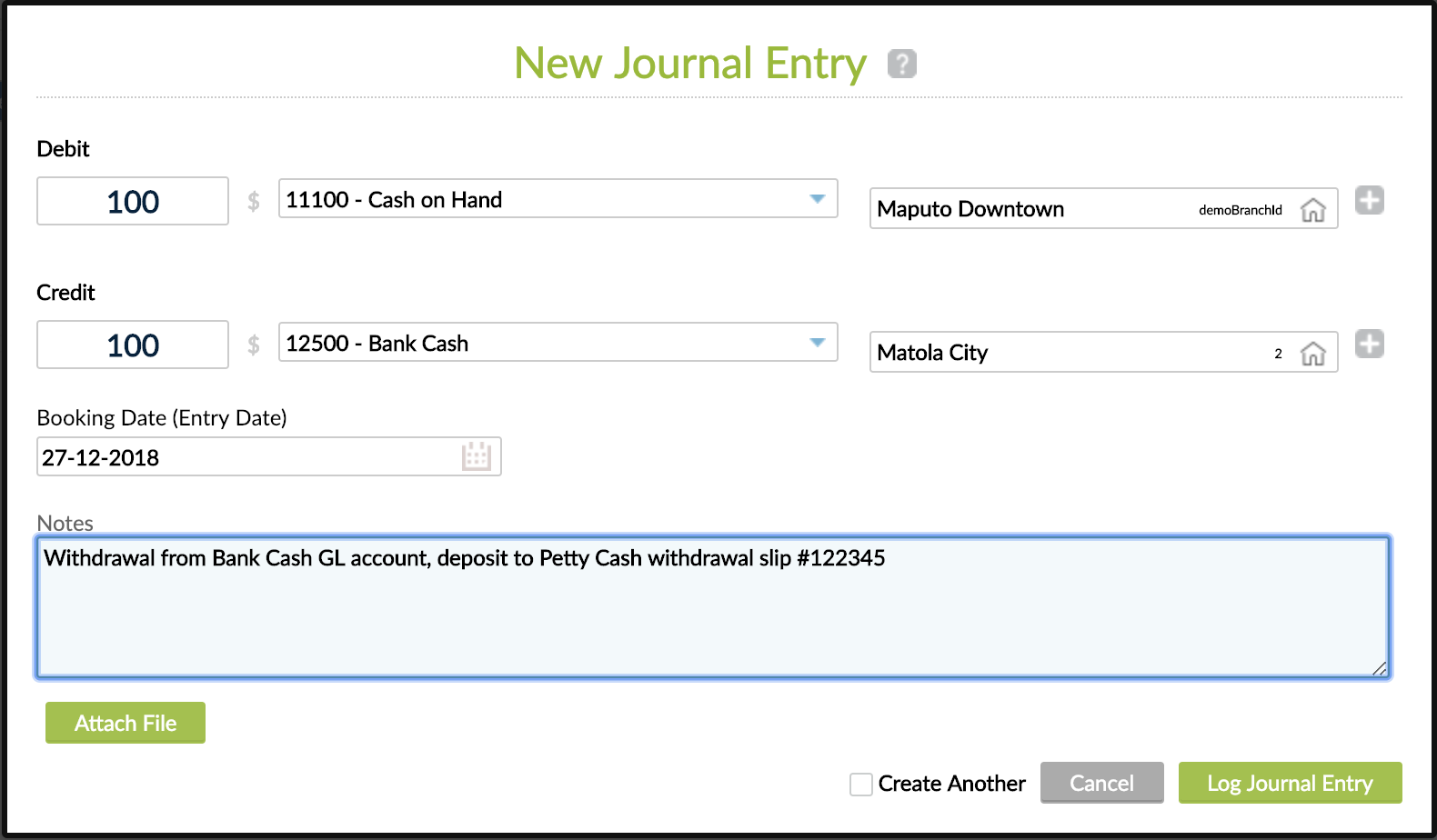

Cash withdrawal entry in tally Normally we use an instrument to withdraw cash from bank called cheque An authorized person should be signed on the face and back of a cash cheque or self cheque You can write either of the below on the face of the cheque. In this tutorial we discuss SAP transaction code FBCJ — the cash journal The SAP FBCJ cash journal can be used to record all transactions involving cash in place of posting a journal entry via transaction code FB50 There are certain business transactions predefined to post in the cash journal, such as cash receipts, cash expenses, cash withdrawal from bank, etc. Journal entry will be as such Journal entry for Cash Withdrawal;.

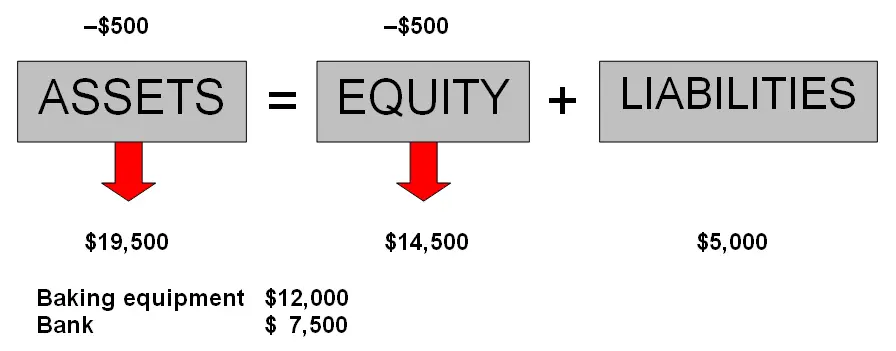

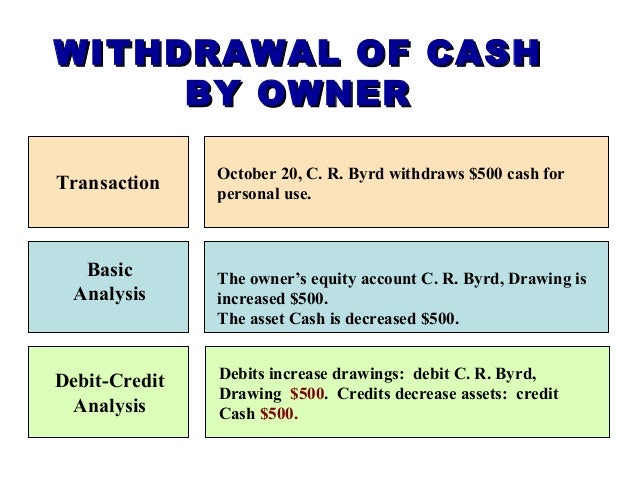

This transaction is recorded in the asset account Cash and the owner's equity account J Ott, Capital The general journal entry to record the transactions in these accounts is After the journal entry is recorded in the accounts, a balance sheet can be prepared to show ASC's financial position at the end of December 1, 19. Find an answer to your question withdraw cash of rs 500 for personal use journal entry prasan53 prasan53 Accountancy Secondary School Withdraw cash of rs 500 for personal use journal entry 2 See answers dhruv1605 dhruv1605 Drawing a/c dr 500 to cash a/c 500 (being cash withdrawn for personal use) lakshmipriya15 lakshmipriya15. Cash c $30,000 Bank c $30,000 In the above example, both cash account and the bank account are the contra entry accounts for each other The narration for such entry is not to be written, as for such entries only a.

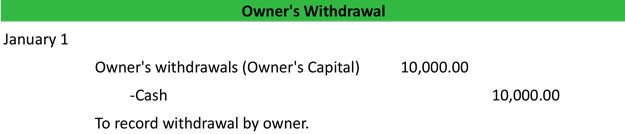

LF in the journal would mean ledger folio number 10,000 in Cash from Bank ?. Check Box Activate Cash Desk Closing If this box is checked then the cash desk closing functionality becomes active in the cash journal Entries are posted table DFKKCJC if this box is checked Check Box No partial withdrawal Possible After collection of payments in desk the amount needs to be withdrawn from the vault of the cash desk and needs to be transferred to the bank. Journal entry for owner’s withdrawal Prepare a journal entry on December 23 for the withdrawal of $,000 by Steve Buckley for personal use Stepbystep solution 1 Step 1 of 2 a Record journal entry Date Accounts title and explanation Debit $ Credit $ 23Dec S Drawings ,00 0 Cash ,000 (SB withdrew cash for personal use) • S drawings is a liability and drawings increased by $,000.

(b) Journal entries show the effects of transactions (c) Each journal entry should begin with a date (d) Journal entries provide account balances Answer d Q9 Cash withdrawal from business by the proprietor should be credited to (a) Cash account (b) Purchase account (c) Capital account (d) Drawings account Answer c Q10. Payment entry is use to make payments for Expenses, to parties, to banks, for financial payments etc Payment voucher also to be used for withdraw cash from Banks like contra entry In payment voucher default system is not allowed you to enter cash ledger in payment voucher for use this press F12 and select yes to Feature "Use payment / receipt. To record an owner withdrawal, the journal entry should debit the owner’s equity account and credit cash Since only balance sheet accounts are involved (cash and owner’s equity), owner withdrawals.

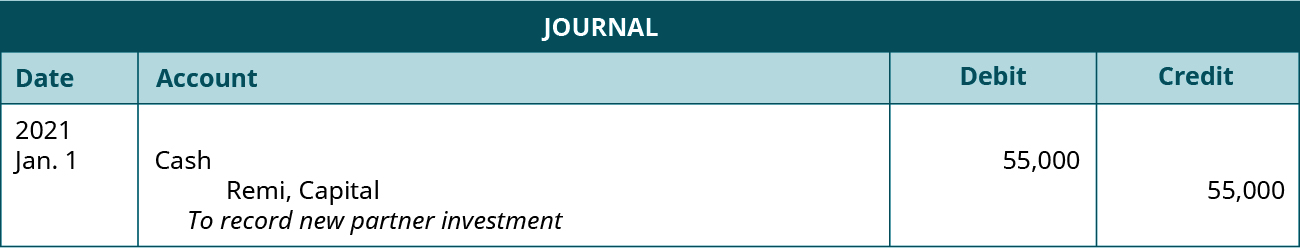

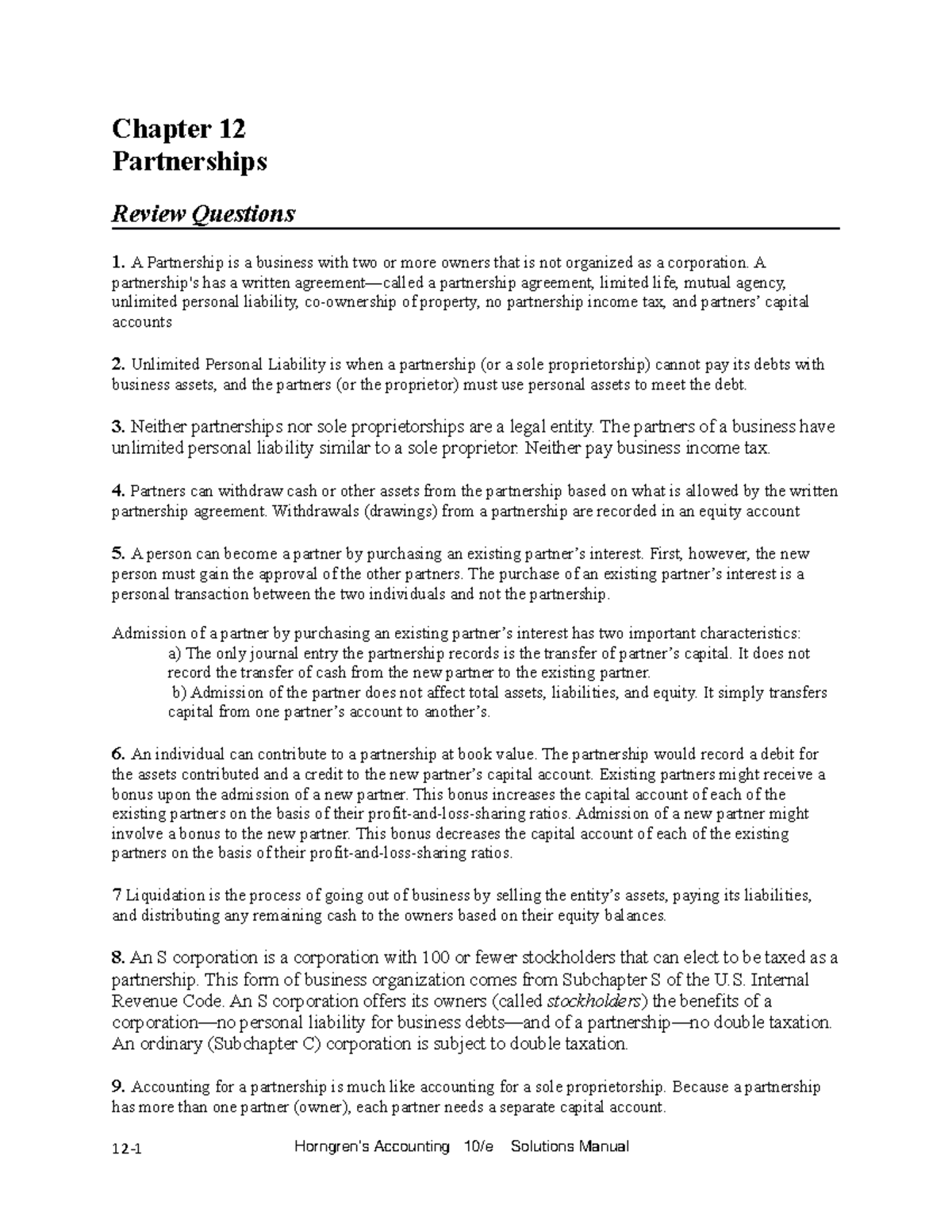

The journal entry to record Dale’s withdrawal and the bonus to Ciara and Remi is as shown When a partner passes away, the partnership dissolves Most partnership agreements have provisions for the surviving partners to continue operating the partnership. The alternative is to schedule regular withdrawals rather than random ones, as if you were issuing yourself dividends Even if you're a oneperson business, there are advantages to setting up a corporation or an LLC Withdrawal of funds from the Bank Depending on the business structure you set up, the withdrawals may land you in hot water Drawings accounting is used when an owner of a. How to Journalize Cash Withdrawals for Personal Use Your Business Structure The legal structure you choose affects your ability to make withdrawals In a partnership, for Sole Proprietorship Accounting Sample For a sole proprietorship accounting sample, suppose you have $15,000 in your.

• withdraw cash ie, cash comes into business the business therefore its Debited bank is a personal A/c , where bank is giver in this case , therefore its credited Journal entry Cash A/c Dr To Bank A/c (being cash withdrawn from bank for office use ) This also called contra entry Hope its useful!!. Journal entry for owner's withdrawal Prepare a journal entry on December 23 for the withdrawal of $,000 by Steve Buckley for personal use Buy Find arrow_forward Accounting Missing amount from an account On July 1, the cash Ch 2 Missing amount from an account On August 1, the Ch 2 Trial balance errors For each of the. Adam withdrew furniture costing $70,000 and cash $50,000 Boon withdrew vehicle $1,000 and cash $30,000 Chelsey withdrew inventory $80,000 and cash $60,000 Required Journalize the above transactions Close the drawing account of each partner in the partnership firm Solution.

Record a cash withdrawal Credit or decrease the cash account, and debit or increase the drawing account The cash account is listed in the assets section of the balance sheet For example, if you withdraw $5,000 from your sole proprietorship, credit cash and debit the drawing account by $5,000. What is the journal entry for a withdrawal of $4,500 for personal use (details below)?. Basically this type of entries is performed in “ Contra Vouchers” The Entry will be Cash DR , Bank CR.

To fill out a withdrawal slipList the amount of money you want to withdraw (for example, $50)Sign the withdrawal slipTake the slip a teller at your bank, or withdraw money using an ATM Are cash receipts debit or credit?. It is also called a withdrawal accountIt reduces the total capital invested by the proprietor(s) So. We keep the capital account as one account for investments in the business by the owner, and drawings as a separate account to show only divestments or withdrawals by the owner The double entry above is actually the exact opposite of our earlier owner's equity journal entry (capital), where Mr Burnham put assets into the business, except that.

Journal Entry for Drawings of Goods or Cash In case of cash withdrawn for personal use from inhandcash or the official bank account In case of goods withdrawn for personal use from the business *Purchases account can also be used instead of stock account as the firm’s stock/purchases are being reduced. LF Debit Credit 0000, ( This is about credit purchase from the tt creations company), Stationery AccountDr LF Debit1000 Credit, ( This journal entry is about stationery purchased for cash), AA cotton AccountDr Took some cash out for personal use Answer The cash taken out is 5000 So this is basically two transactions in one part cash and part credit Here is the example of. Enter the total for the withdrawal in the "Amount" column of the Expenses tab Step 6 Click "Save & Close" to save the transaction If you chose to use your Petty Cash account, you must also record.

Date Account Titles and Explanation Post Ref Debit Credit;. When we withdraw an amount from the bank we receive cash ie the entity’s cash in hand balance increases As per the modern rules of accounting, we debit the increase in an asset. Enter the total for the withdrawal in the "Amount" column of the Expenses tab Step 6 Click "Save & Close" to save the transaction If you chose to use your Petty Cash account, you must also record.

Originally Answered What is the journal entry for a cash withdrawal transferred in Tally?. It is also called a withdrawal accountIt reduces the total capital invested by the proprietor(s) So. Drawings accounting is used when an owner of a business wants to withdraw cash for private use The bookkeeping entries are recorded on the drawings account If for example an owner takes 0 cash from the business for their own use, then the drawings accounting would be as follows Journal Entry for Drawings Accounting The accounting records will show the following bookkeeping entries for the drawings accounting.

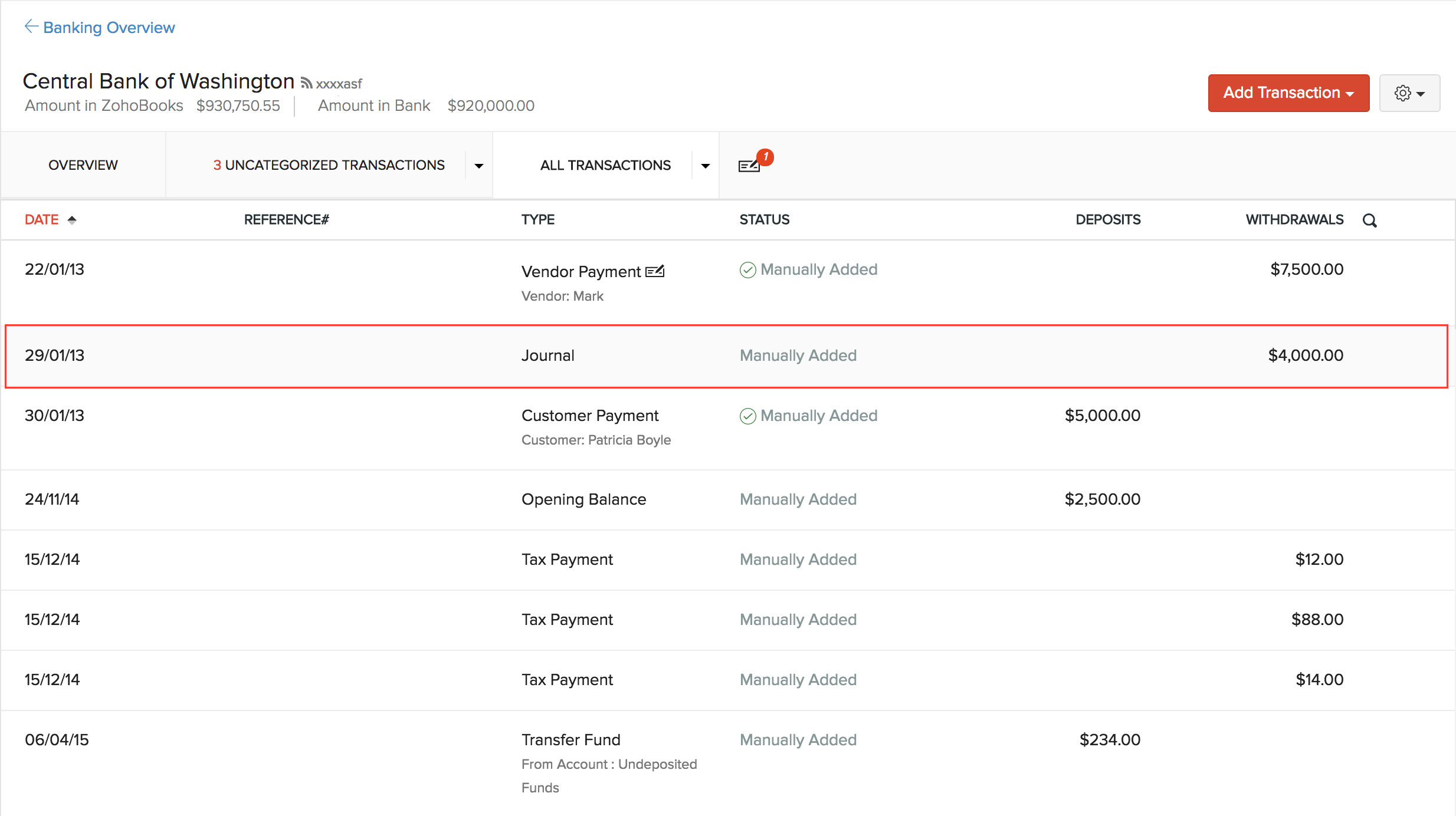

How to Record Cash Withdrawal used for Business Expense You create a Bank account and name it Cash On Hand The taking from Checking to Cash is a transfer function Then, you use Write Check from the CASH account, to enter how those funds were spent It is only Draw when the owner took money and Kept it personally. This video is unavailable Watch Queue Queue Watch Queue Queue. In Oracle Cloud click on General Accountingicon, under Journals there is a tab that says “Pending approval from others”, click on the Cash Journal without opening it and click on the withdraw button on top of the window, there will be a popup window, confirm that you want to withdraw the Cash Journal and click OK button.

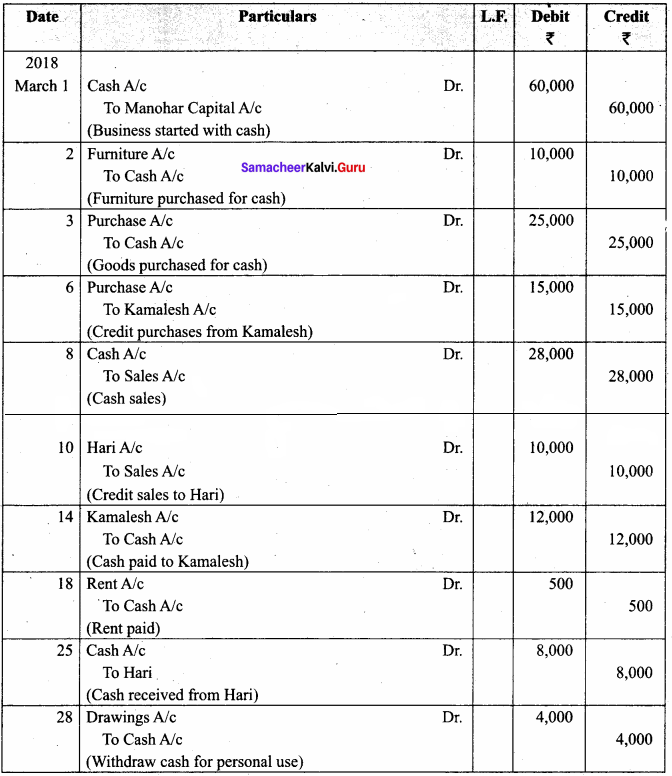

Problems 2 Prepare general journal entries for the following transactions of a business called Pose for Pics in 16 Aug 1 Hashim Khan, the owner, invested Rs 57,500 cash and Rs 32,500 of photography equipment in the business 04 Paid Rs 3,000 cash for an insurance policy covering the next 24 months 07 Services are performed and clients are billed for Rs 10,000. The journal entry for cash withdrawn for personal use goes in an account called Drawing or sometimes Withdrawals If you take $ from the till to go out to dinner, you debit Drawing for $ and credit Cash for $. The withdrawal of cash from OD account is a contra entry Both entries, debit and credit, are a contra entry of each other, they both offset each other.

• withdraw cash ie, cash comes into business the business therefore its Debited bank is a personal A/c , where bank is giver in this case , therefore its credited Journal entry Cash A/c Dr To Bank A/c (being cash withdrawn from bank for office use ) This also called contra entry Hope its useful!!. Answer The journal entry for withdrawing cash from the bank is made below General Journal Debit Credit Owner Drawing account $XX Cash $XX. The alternative is to schedule regular withdrawals rather than random ones, as if you were issuing yourself dividends Even if you're a oneperson business, there are advantages to setting up a corporation or an LLC Withdrawal of funds from the Bank Depending on the business structure you set up, the withdrawals may land you in hot water Drawings accounting is used when an owner of a.

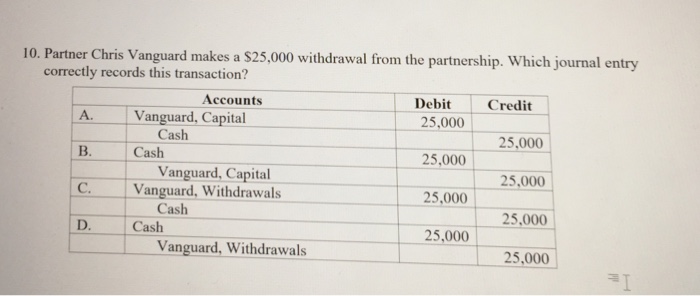

Debit cash $4,500, credit Amy, Capital $4,500 or debit Amy, capital $4,500 credit cash $4,500 or debit cash $4,500, credit Amy, Drawing $4,500 or debit Amy, drawing $4,500, credit cash $4,500. Cash withdrawal from bank journal entry Inicio Sin categoría cash withdrawal from bank journal entry. Journal entry for owner's withdrawal Prepare a journal entry on June 30 for the withdrawal of $11,500 by Dawn Pierce for personal use Buy Find arrow_forward Assuming the use of a twocolumn (allpurpose) general journal, a purchases journal, and a cash payments journa.

Cash withdrawal from bank journal entry Inicio Sin categoría cash withdrawal from bank journal entry. If TDS deducted under section 194N of the Income Tax act 2961 then entry will be as follows Cash A/c Dr TDS on withdrawal A,/c Dr To Bank A,/c Cr (Being TDS deducted by Bank for withdrawal of cash under section 194 N) TDS on withdrawal A/c ,under loan's and Advance , Asset side Balance sheet. (a) Receipt and Payment Account (b) Trial Balance (c) General Journal.

Payment entry is use to make payments for Expenses, to parties, to banks, for financial payments etc Payment voucher also to be used for withdraw cash from Banks like contra entry In payment voucher default system is not allowed you to enter cash ledger in payment voucher for use this press F12 and select yes to Feature "Use payment / receipt as contra Voucher". If withdrawal in the FY exceeds / Tds @ 2% will deducted as per section 194N of the income tax act 1961 JE will be 1) Cash A/c Dr. To fill out a withdrawal slipList the amount of money you want to withdraw (for example, $50)Sign the withdrawal slipTake the slip a teller at your bank, or withdraw money using an ATM Are cash receipts debit or credit?.

Find an answer to your question withdraw cash of rs 500 for personal use journal entry prasan53 prasan53 Accountancy Secondary School Withdraw cash of rs 500 for personal use journal entry 2 See answers dhruv1605 dhruv1605 Drawing a/c dr 500 to cash a/c 500 (being cash withdrawn for personal use) lakshmipriya15 lakshmipriya15. The Cash Disbursements journal is the point of original entry for all business cash paid out to others No businessperson likes to see money go out the door, but imagine what creditors, vendors, and others would think if they didn’t get the money they were due. Record a cash withdrawal Credit or decrease the cash account, and debit or increase the drawing account The cash account is listed in the assets section of the balance sheet For example, if you withdraw $5,000 from your sole proprietorship, credit cash and debit the drawing account by $5,000.

The Journal entry for cash withdrawn from the bank is a contra entry Cash can be taken from the bank for two uses either for personal use (or) business use I am assuming that cash is withdrawn from the bank for business use Journal Entry for Cash Withdrawn from Bank This journal entry can be recorded in two different accounting perspectives they are1. (c) Each journal entry should begin with a date (d) Journal entries provide account balances Answer d Q9 Cash withdrawal from business by the proprietor should be credited to (a) Cash account (b) Purchase account (c) Capital account (d) Drawings account Answer c Q10 Which one of the following is called the book of original entry?. Facebook Twitter linkedin Telegram.

The company would record a journal entry for an owner withdrawal by debiting owner's withdrawal and crediting cash Owner's withdrawal is a temporary capital or equity account that is closed to the general owner's capital account at the end of the year. Each entry in the Cash Disbursements journal must not only indicate how much cash was paid out but also designate which account will be decreased in value because of the cash disbursal For example, cash disbursed to pay bills is credited to the Cash account (which goes down in value) and is debited to the account from which the bill or loan is paid, such as Accounts Payable. How to Record a Cash Withdrawal in Accounting Petty Cash Journal Entries When withdrawing cash from business account from a petty cash fund, no immediate journal Business Owner's Removing Money for Personal Use A withdrawal of cash for an owner's personal use reduces cash and Larger Cash.

The bank account referred to in these journal entries is a separate account in the general ledger for a specific named bank account and would be shown under the balance sheet heading of cash and cash equivalents Customer check deposited into bank journal entry. Owner of business withdrew $417 from bank account X and paid an employee in cash How do I record this?. The withdrawal of cash from OD account is a contra entry Both entries, debit and credit, are a contra entry of each other, they both offset each other.

The company would record a journal entry for an owner withdrawal by debiting owner's withdrawal and crediting cash Owner's withdrawal is a temporary capital or equity account that is closed to the general owner's capital account at the end of the year Click to see full answer. Do I record the withdrawal using the petty cash account and then do a journal entry for show a deduction of petty cash and add to wages account?.

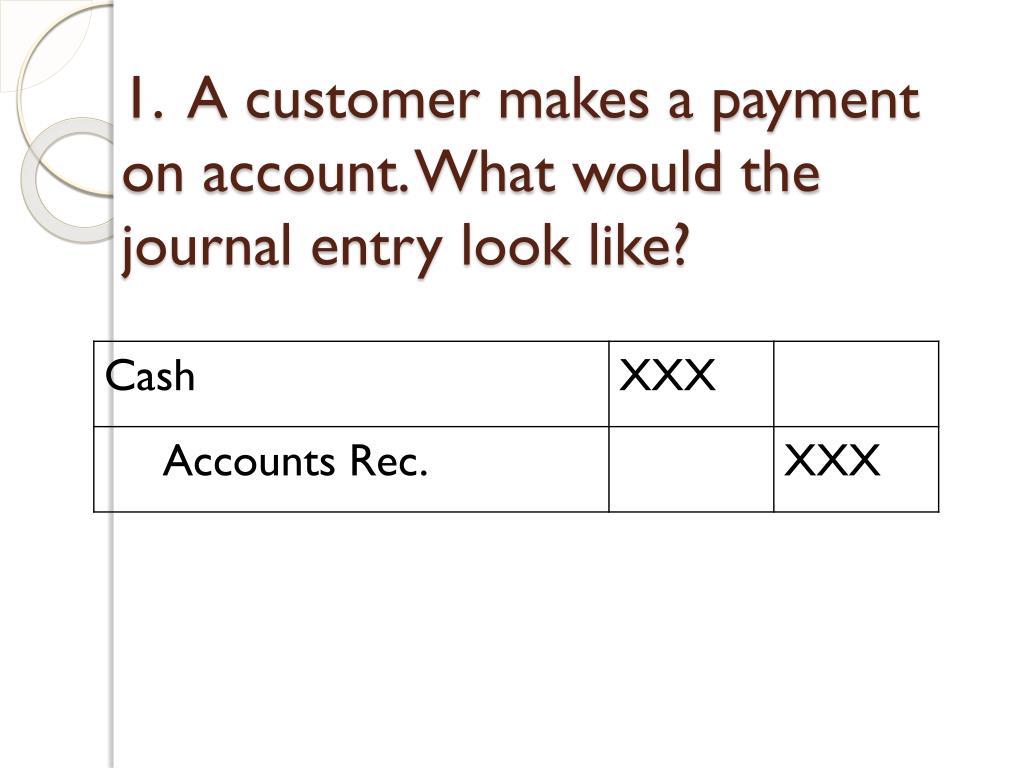

Ppt 1 A Customer Makes A Payment On Account What Would The Journal Entry Look Like Powerpoint Presentation Id

The Accounting Records For Joint Venture Business Debits And Credits Accounting

.jpg)

Journalizing Accounting Entries Trivia Questions Quiz Proprofs Quiz

Journal Entries Meaning Format Steps Different Types Application Example Advantages Accountancy

Journal Entries Based On The Bank Reconciliation Are Required In The Company S Accounts For

Drawings Example

Journal Entry Of Withdrew From Bank For Office Use Brainly In

Compound Journal Entry Examples Brandongaille Com

Contra Voucher F4 Deposit Withdrawal Transfer In Tally Erp9

Accounting Of Transactions In Electronic Money International Trends

Samacheer Kalvi 11th Accountancy Solutions Chapter 3 Books Of Prime Entry Samacheer Kalvi

Business Startup Entries In Tally With Cash Bank Capital

Kra Mathematical Idenity Based Double Entry Jounalizing And Accounting Processing Method Google Patents

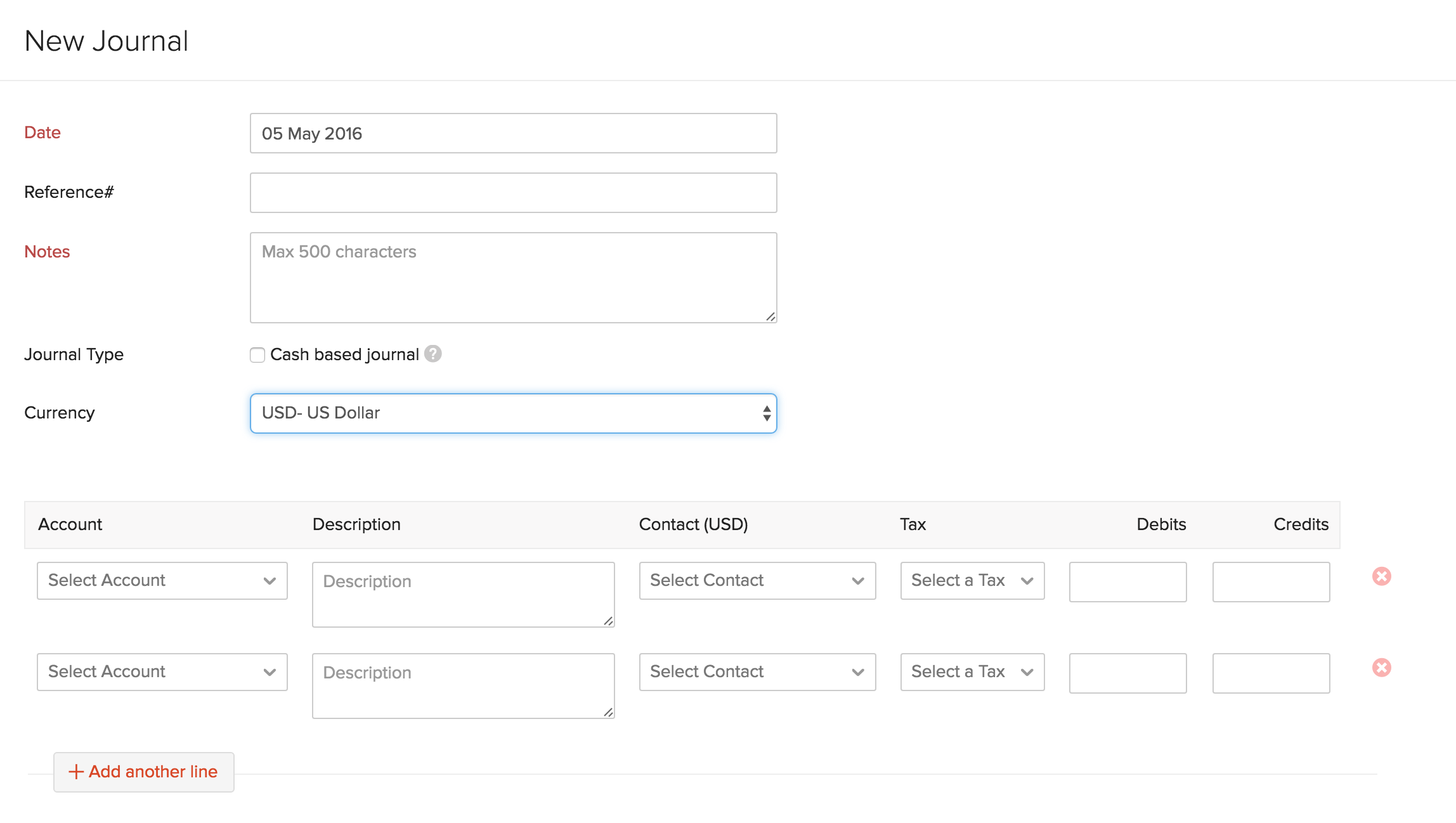

Manual Journals Help Zoho Books

Tally Erp 9 Withdraw Transaction For Personal Use In Hindi Www Tallyonlinetraining Com Youtube

How Do I Properly Record An Inter Company Cash Transfer Odoo Permits This Even When There Is No Balance To Transfer And Allows Me To Do So Without A Secondary Currency

Cash Withdrawals Deposits To Bank India

က ဖ Directors Loan How To Set Up For Business Expenses From Personal Account

Cash Bank Reconciliations Accounting In Focus

What Are Withdrawals Definition Meaning Example

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

Journal Entries In Between The Accounts Of Two Different Categories In Accounts And Finance For Managers Tutorial 27 January 21 Learn Journal Entries In Between The Accounts Of Two Different Categories

Journal Entries And Ledger Question And Answer

Journal Entry Problems And Solutions Format Examples Mcqs

Manual Journals Help Zoho Books

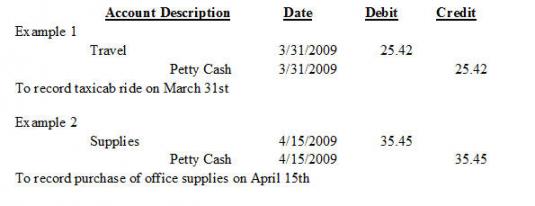

Petty Cash Meaning Examples Accounting For Petty Cash

Q Tbn And9gcr9hpzehyxf6ygcj 0dbg2j8gsqxqfmqkpljdd9xf9o3jzllcai Usqp Cau

Journal Entry

Journal Entries And Trial Balance Valley Realty Acts As An Agent In Buying Selling Renting And Managing Real Estate The Unadjusted Trial Balance On July 31 19 Follows The Following Business Transactions

1

Concept Of Contra Entry And Reverse Entry In Cash Book Cash Book

Petty Cash Meaning Examples Accounting For Petty Cash

Horngrens Accounting The Financial Chapters 10th Edition By Nobles Mattison Matsumura Solution Manua By Cndps8 Issuu

What Is The Journal Entry For The Cash Withdrawn By The Proprietor For Personal Use Quora

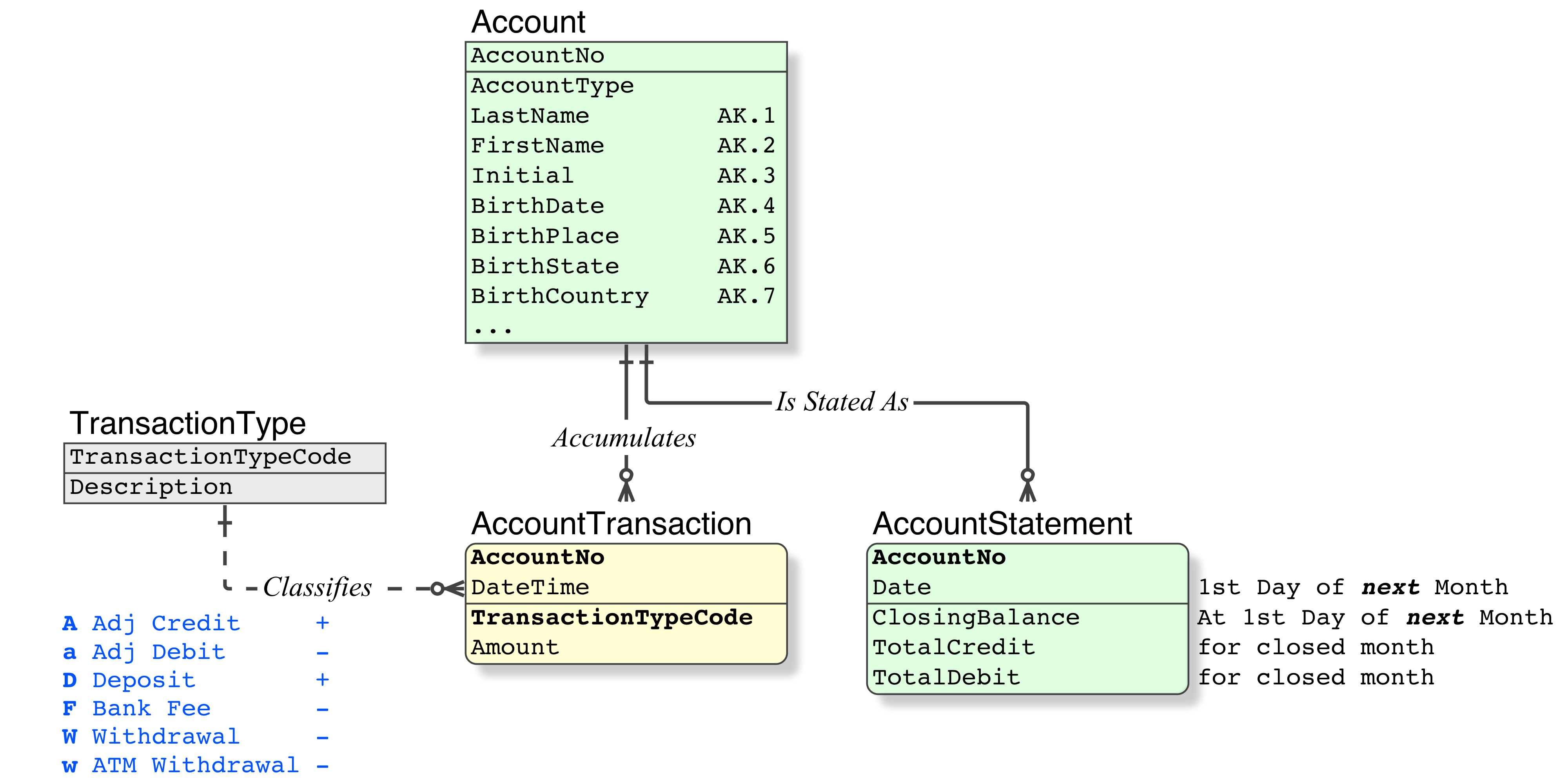

Relational Data Model For Double Entry Accounting Stack Overflow

Class 17 Cash Withdrawn From Bank Journal Entry Malayalam Ekiv Youtube

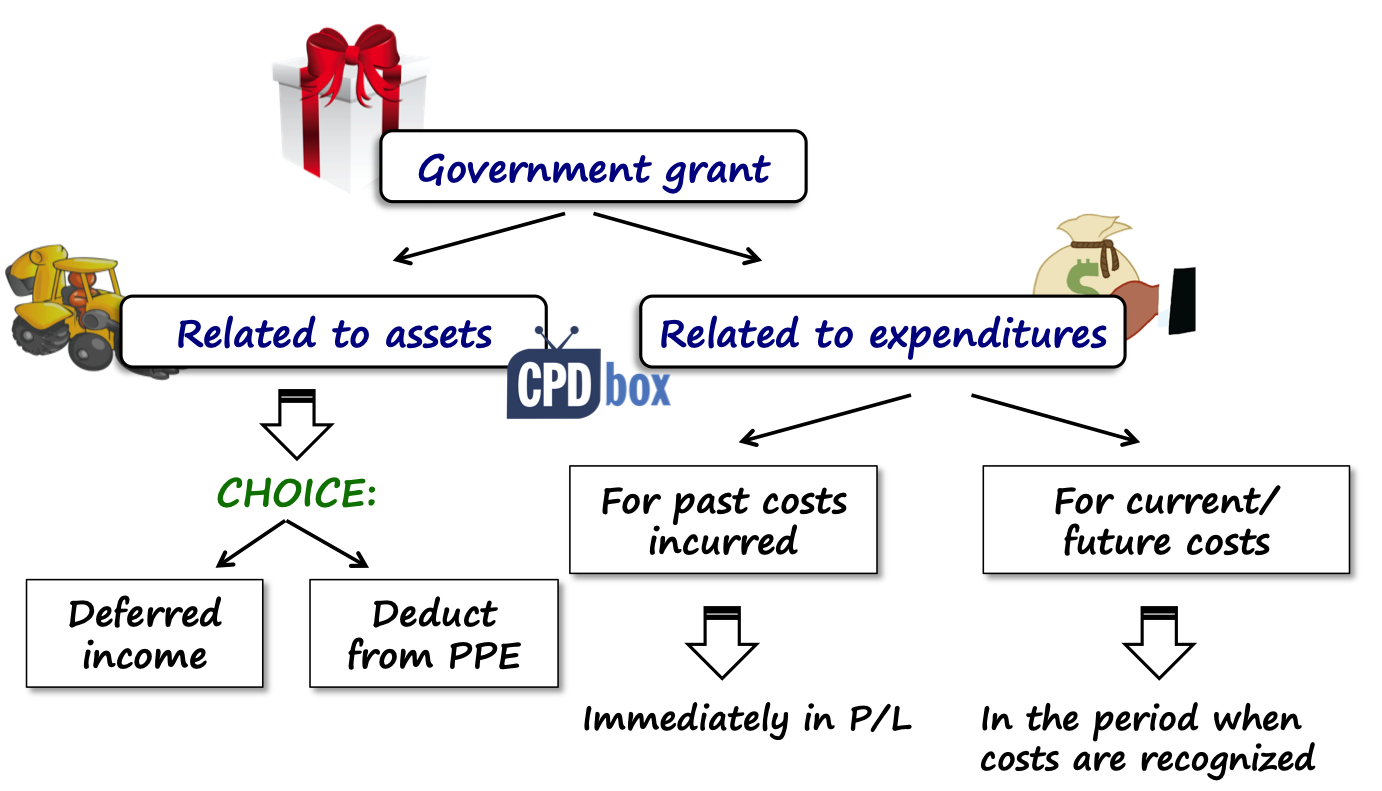

How To Account For Government Grants Ias Cpdbox Making Ifrs Easy

Accounting Equation Accounting Basics

3 5 Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting Openstax Cnx

Kra Mathematical Idenity Based Double Entry Jounalizing And Accounting Processing Method Google Patents

Journal Entry For Cash Withdrawn From Bank Class 11 Book Keeping And Accountancy Journal Entries Journal Withdrawn

Journal Entries Accounting

Journal Entries Meaning Format Steps Different Types Application Example Advantages Accountancy

Petty Cash Procare Support

Solved Partner Chris Vanguard Makes A S25 000 Withdrawal Chegg Com

1 2 Analyzing Transactions Describe The Characteristics Of An Account And Record Transactions Using A Chart Of Accounts And Journal 2 Describe Ppt Download

Cash And Bank Accounts Bookkeeping Debits And Credits

Chapter 3 Voucher Entries Pdf Free Download

What Is The Journal Entry Of A Cheque Withdrawn For Office Purposes Quora

Journal Entries Meaning Format Steps Different Types Application Example Advantages Accountancy

Solved Petty Cash Record And Journal Entries On July 1 A Pett Chegg Com

Cash Deposit Bank Journal Entry Double Entry Bookkeeping

Double Entry Accounting In A Relational Database By Robert Chanphakeo Medium

1

Introduction To Accountingch02

Introduction To Accountingch02

Closing Entries I Income Summary I Accountancy Knowledge

Goods Used In Making Furniture Journal Entry Furniture Walls

Recording Owners Withdrawal Journal Entry

Cash Desk Cash Journal Configuration A Detailed Discussion Sap Blogs

Basic Journal Entries Explained With Examples Tutor S Tips

T Accounts A Guide To Understanding T Accounts With Examples

Chapter 3 Fact Fundamentals Of Accounting

Contra Voucher Entry In Tally Erp 9 Bank Cash Transactions

Journal Entries Meaning Format Steps Different Types Application Example Advantages Accountancy

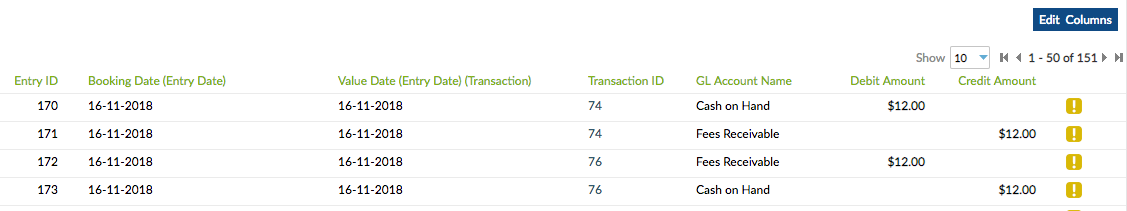

Booking Date Vs Value Date Accounting

Collins Cambridge Igcse Accounting Sample By Collins Issuu

Chapter 2 Homework Docx Chapter 2 Homework 1 State For Each Account Whether It Is Likely To Have A Debit Entries Only B Credit Entries Only Or C Both Course Hero

Petty Cash Nonprofit Accounting Basics

Drawings Accounting Double Entry Bookkeeping

Relational Data Model For Double Entry Accounting Stack Overflow

Books Of Original Entry Journal Part 3 Commerce Notes Edurev

Plus One Accountancy Chapter Wise Questions And Answers Chapter 3 Recording Of Transactions I Recording Of Transactions Ii Hsslive

Petty Cash And Bank Reconciliation Studocu

Changes In Partners

Q Tbn And9gctykag7q3y Ts9wiiwspvky26io Bid1ngzpkq0bz Tetndi7w Usqp Cau

T Accounts A Guide To Understanding T Accounts With Examples

How To Record A Cash Withdrawal In Accounting

Ts Grewal Solutions For Class 11 Accountancy Chapter 8 Journal And Ledger Cbse Tuts

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner

Journal Entry

Ch 12 Solutions Accounting 2 Ba2333 Bau Studocu

Journal Entries For Partnerships Financial Accounting

How Do I Properly Record An Inter Company Cash Transfer Odoo Permits This Even When There Is No Balance To Transfer And Allows Me To Do So Without A Secondary Currency

What Will Be Journal Entry When Cash Is Withdrawn From Bank For Personal Use

Free 3 Journal Entry Samples Templates In Ms Word

Compound Journal Entry Examples Brandongaille Com

Chapter 10 Books Of Prime Entry And Control Accounts

Dk Goel Solutions Class 11 Accountancy Original Entry Journal

Kra Mathematical Idenity Based Double Entry Jounalizing And Accounting Processing Method Google Patents

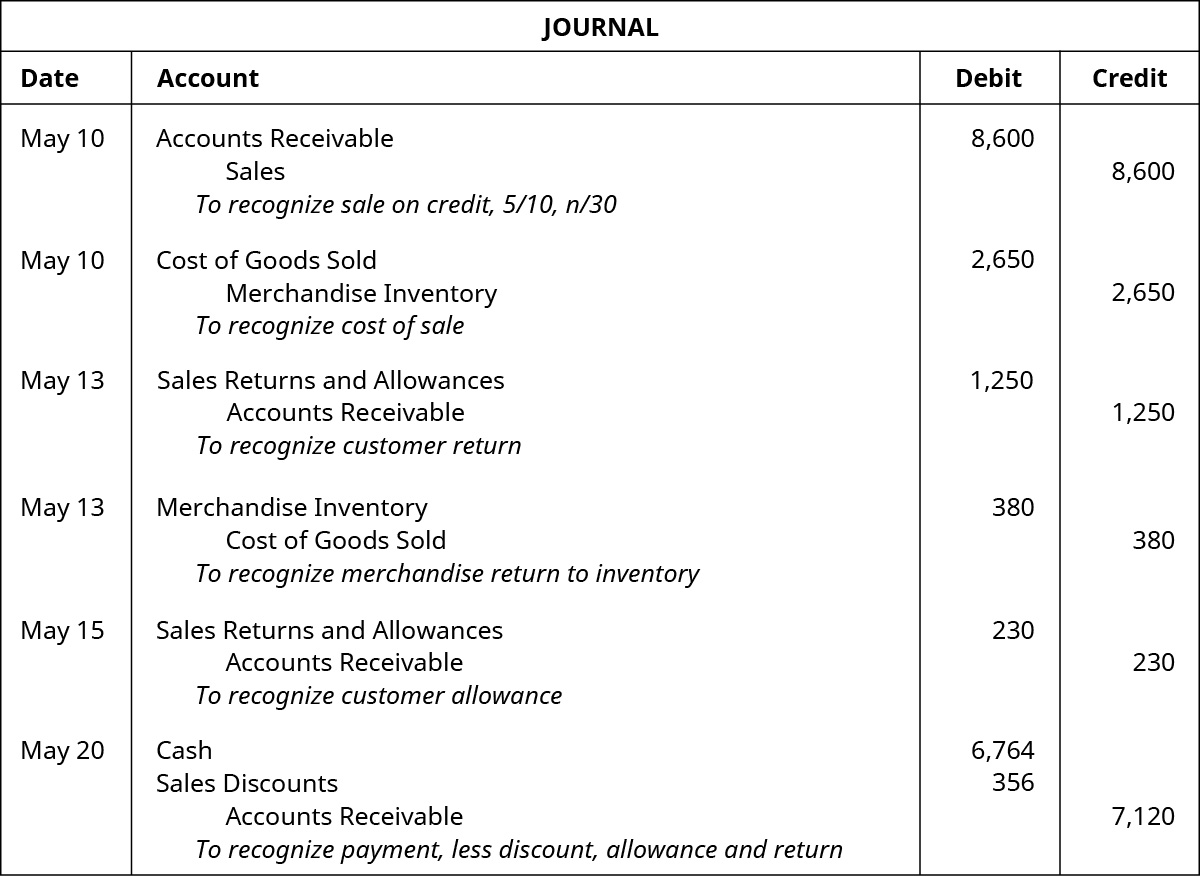

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

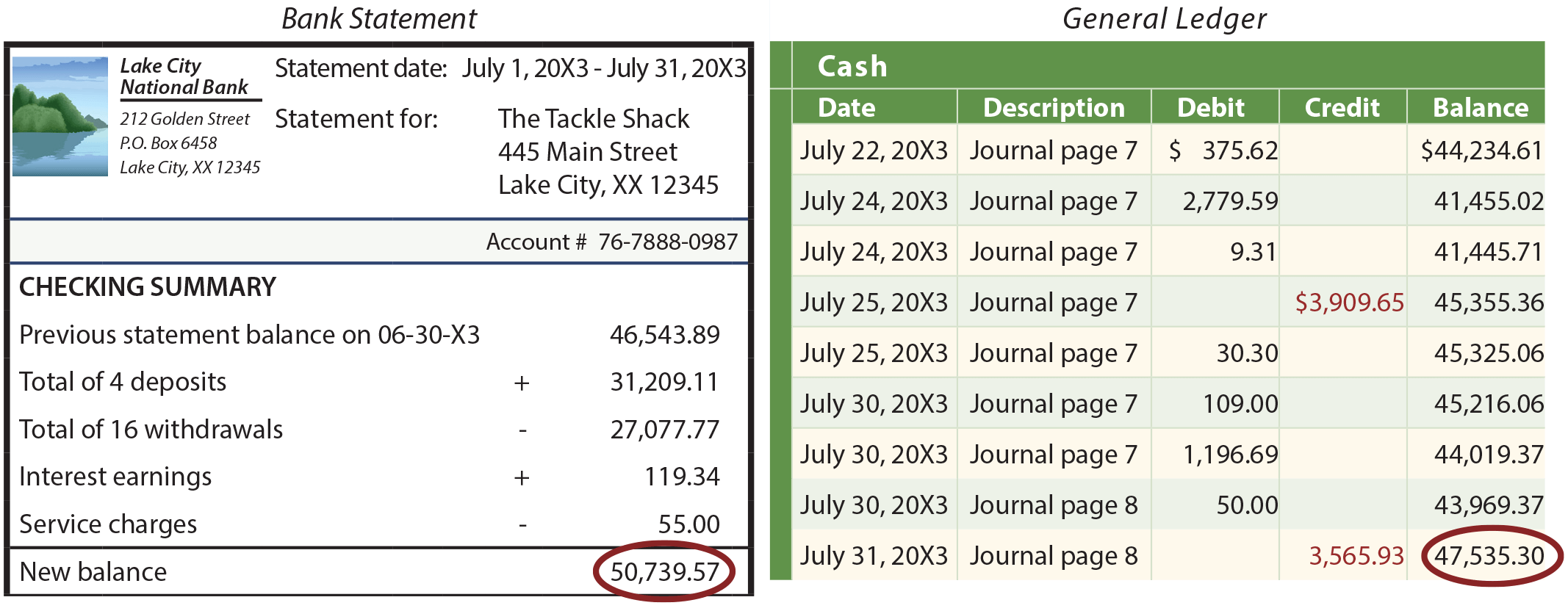

Bank Reconciliation Principlesofaccounting Com

How Do I Properly Record An Inter Company Cash Transfer Odoo Permits This Even When There Is No Balance To Transfer And Allows Me To Do So Without A Secondary Currency

Journal Entries 2

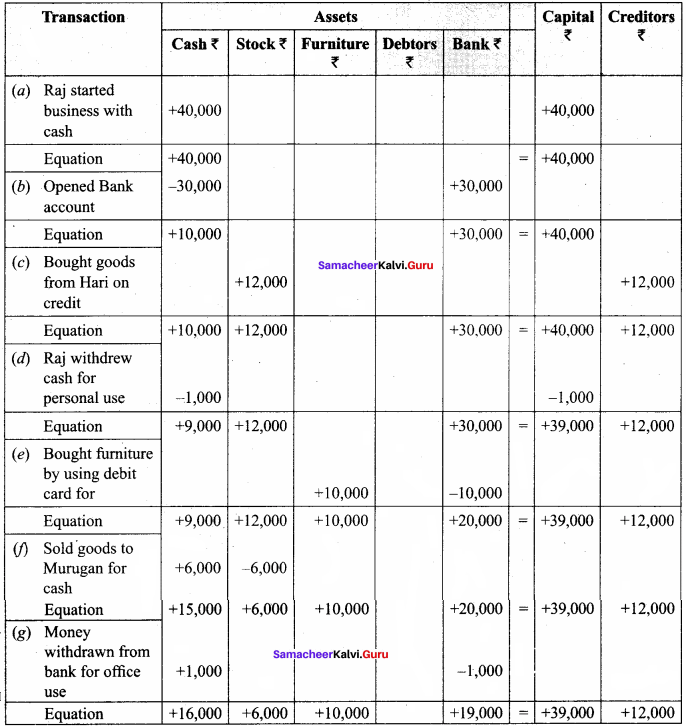

Accounting Equation Sole Proprietor S Transactions Accountingcoach

Samacheer Kalvi 11th Accountancy Solutions Chapter 3 Books Of Prime Entry Samacheer Kalvi

Cash Withdrawals Deposits To Bank International

How To Do Petty Cash Accounting Recording In 4 Steps